The shipping industry, responsible for transporting around 90% of the world’s goods, has come under increasing scrutiny due to its significant contribution to global carbon emissions, estimated at 3% annually—surpassing even Japan’s yearly emissions. The industry faces growing pressure to reduce its carbon footprint, driven by climate change concerns and regulatory changes.

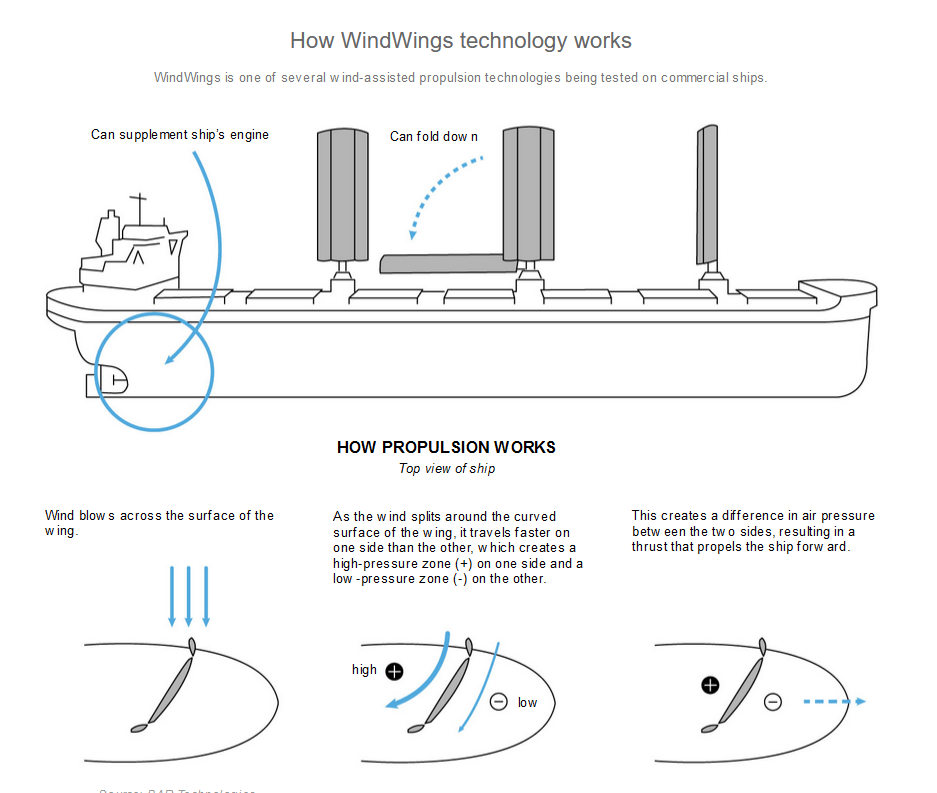

A promising solution involves reviving wind-assisted propulsion technology, an age-old method of harnessing wind power to propel ships. Picture large vertical wings resembling Boeing 747 wings on a ship’s deck, equipped with movable flaps controlled by computerized sensors. These wings adjust to optimize wind speed and direction, significantly reducing the ship’s reliance on fuel and curbing carbon emissions.

“Shipping is kind of unique,” says Gavin Allwright, secretary-general of the International Windship Association (IWSA), a not-for-profit trade organization that advocates for wind propulsion in commercial shipping. From antiquity, ships used clean and free wind energy, “then we carbonized and now we’re going back to zero carbon.”

The renewed interest in wind-assisted propulsion began in the early 2010s, with approximately 30 large commercial ships currently experimenting with various wind technologies. Industry leaders like Maersk and NYK are among the pioneers, and up to 20 more ships are expected to join this trend soon. These vessels serve as testbeds to determine the commercial viability of wind-assisted propulsion.

One notable trial involved retrofitting the 751-foot bulk carrier Pyxis Ocean with rigid sails known as WindWings. These 123-foot-tall articulated fiberglass and metal wings create lift and propel the ship using wind force. During the retrofit, the ship achieved speeds of up to 16.2 knots (18.6 mph) with WindWings working alongside the ship’s minimal engine power. The potential for wind-assisted propulsion is clear.

The shipping industry faces regulatory changes aimed at reducing emissions. In 2024, the International Maritime Organization (IMO) will grade ships based on their cargo capacity and CO2 emissions per nautical mile, requiring vessels with low ratings to take corrective measures or face operational restrictions. The European Union’s Emissions Trading System will also include the maritime industry, forcing shippers to pay for their carbon emissions.

While retrofitting ships with wind technology can be a substantial investment, averaging between $3 million to $4 million on a $100 million ship, proponents argue that it’s a worthwhile expense.

However, it may take seven to ten years to recoup the initial investment on retrofitted ships, potentially discouraging commercial operators. Future ships purpose-built for wind technology and cleaner fuels could significantly shorten the payback period, making wind-assisted propulsion more attractive.

Moreover, the use of cleaner fuels like ammonia and methanol, in combination with wind technology, could further reduce emissions and operating costs. As the industry explores these alternatives, wind-assisted propulsion represents a promising step toward a greener future for the notoriously polluting shipping industry.

Additionally, it could revive old clipper ship routes that have fallen out of favor, potentially reshaping global trade routes and making them more sustainable.