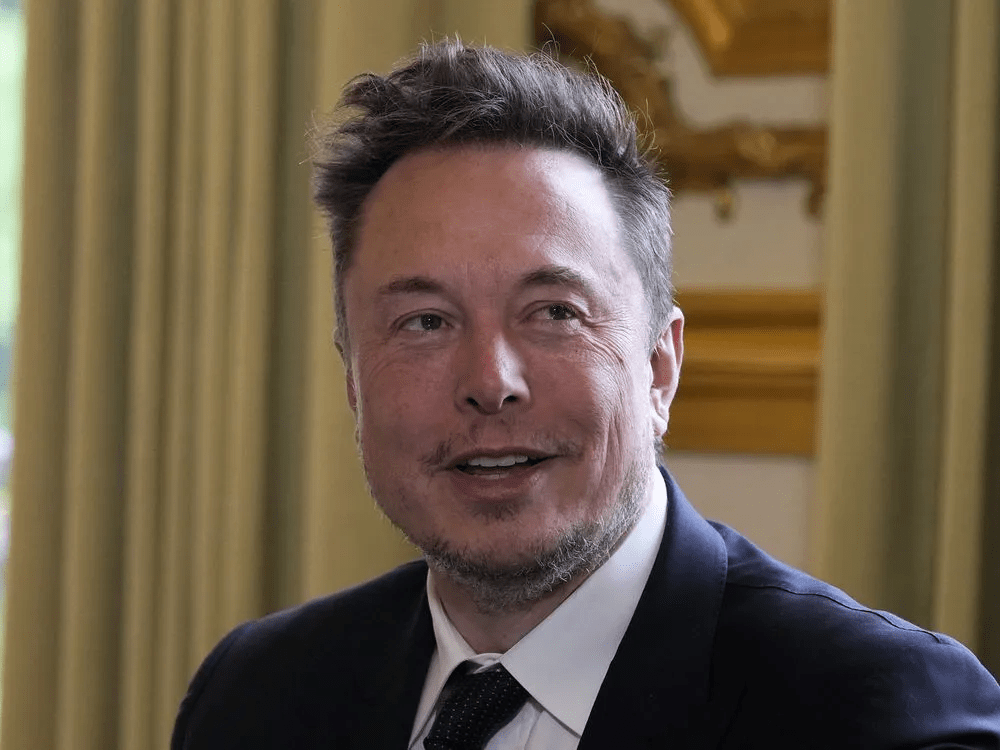

In a new development, the Securities and Exchange Commission (SEC) is now looking into Elon Musk’s acquisition of Twitter for $44 billion and subsequent purchase of the company. This development comes after Musk refused to give his testimony in response to a subpoena.

The SEC submitted a request to a California federal court to compel Musk to honor a subpoena issued in May, seeking his testimony. The filing disclosed an ongoing nonpublic investigation into whether Musk breached federal securities laws during his discreet acquisition of Twitter stock in early 2022 and his later purchase of the entire company. The investigation also scrutinizes Musk’s statements regarding the deal.

While it was previously acknowledged that Musk was under federal investigation, specific details regarding the investigating body and the nature of the investigation were undisclosed until now.

The SEC emphasized that Musk’s testimony is crucial for obtaining information not yet in their possession, which is pertinent to their ongoing lawful investigation. Despite Musk providing partial testimony in July 2022, the agency deems further questioning necessary due to the substantial influx of new information gathered this year.

Musk’s legal representative, Alex Spiro, argued that the SEC had already obtained Musk’s testimony multiple times and deemed the continued investigation misguided. However, the SEC contended that Musk’s abrupt refusal to comply with the subpoena, citing various objections, warranted their pursuit to compel his testimony.

Among Musk’s objections were concerns about the chosen testimony location and allegations of harassment by the SEC. Despite attempts to reschedule the interview, Musk maintained a blanket refusal to appear for testimony.

The SEC is now seeking intervention from the court to enforce Musk’s compliance and ensure his participation in the interview. The situation remains ongoing and continues to attract attention and speculation within financial and regulatory circles.