Letting Twitter decide how you pay your taxes? Probably not the smartest decision…

Tesla CEO Elon Musk came up with a brilliant yet risky idea to let people on Twitter decide whether he should pay taxes or not so he did what every other richest man on the planet does, he made a poll. Musk asked the Twitterverse whether he should sell 10% of his Tesla stock and promised that he would honor the results, “whichever way it goes”. The results came out and majority of people voted “yes” in favor of the stock selling.

Musk launched the poll on Saturday after the recent legislative proposal to tax unrealized gains or profits existing on paper only that only become real until the investment is sold. Many people are against this as this allows a lot of billionaires to avoid paying taxes. For context, Musk explained that he receives payment from his companies in stock and doesn’t take cash or bonus. Therefore, “the only way for me to pay taxes personally is to sell stock,” said Musk.

Out of the total stock, Musk owns more than 17% share in the Tesla stock which is valued at more than $200 billion according to Wall Street Journal. Selling 10% of that would amount to $21 billion at the current price.

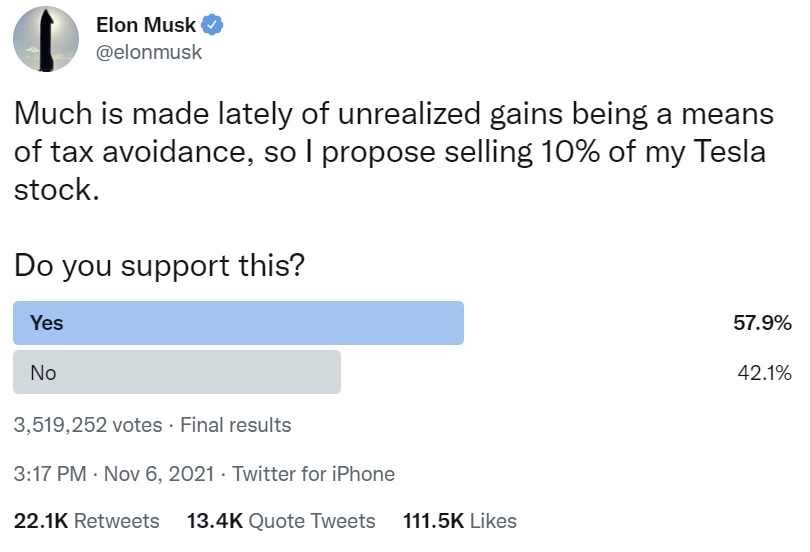

“Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock,” Musk wrote in the tweet with his poll, adding: “I will abide by the results of this poll, whichever way it goes.” A total of 3.5 million people voted on Musk’s poll, out of which 57.9% voted in favor of selling his stock while 42.1% were against it (maybe those were his fake accounts?)

It looks like there hasn’t been much noise from Musk’s end after the poll results which is a little suspicious since he said he was prepared to accept both outcomes. So when is he going to sell his stock is the real question or if he’ll chicken out from the deal (which wont be a first for him either)