Evidence for robot domination cannot be more clear, as after creeping into our restaurants, hospitals, and transportation, they are now asserting their presence on the Wall Street.

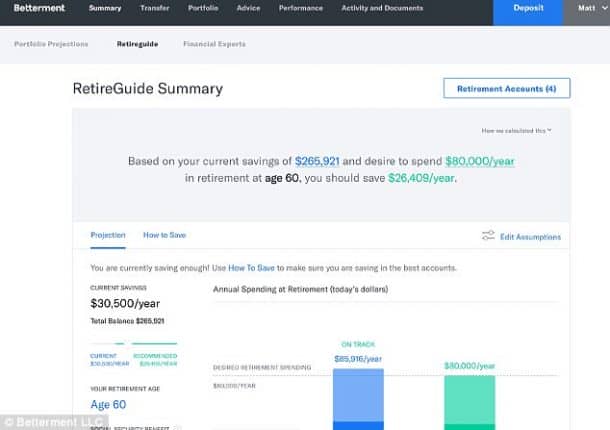

New York-based startup Betterment has revealed that thousands of their customers have been working with their digital employees, with

‘a number of them are worth more than $10 million under management each.’

Traditional banks like the Citigroup still reiterate the importance of ‘face-to-face advice’ with their high valued clients, but this remarkable exposure is an indicator of a significant paradigm shift and how things will unfold for the financial sector in the future.

Betterment is determined to prove the traditional line of thought wrong as their AI-powered Robo-advisers work using a software that provides customers with financial advice or portfolio management and requires minimal human intervention. Not only the technology provides investment advice, but they also run at a cheaper rate than human brokers, often charging half the rates.

Betterment is a minority but still not alone in embracing AI, since other major players like Goldman Sachs, JP Morgan Chase, and Charles Schwab are also embracing the technology.

According to Verhage, Betterment has realized that robo-advising is bound to take off and has made a wise move to embrace it,

‘These are fundamental decisions about who we are as a company,’ Founder and Chief Executive Officer Jon Stein told Bloomberg in an interview.

‘We’re attracting a lot of affluent customers already, but I think our voice—as we speak to that person—has to show we are established.’

Betterment already has a host of customers working with AI robots that have a total market value of at least $10 million, and the technology is tipped to be managing as much as an aggregate of $2.2 trillion in the coming four years.

Firms like Morgan Stanley and Wells Fargo currently view robo-advisers as complimentary services alongside human employees.

‘Robo is a positive disruptor,’ Jay Welker, president of Wells Fargo’s private bank, told Bloomberg.

‘We think of robo in terms of serving multi-generational families.’

This plan seems to be the win-win case for the current scenario since it would allow the companies to stay ahead of the technology change and benefit from the efficiency of advanced technology while still holding on the need for “human connection.”