Enthusiasm around 5G, and its vow of lightning-fast download speeds and large data capacity, has moved up since the first 5G-enabled iPhone was launched last fall. But the real experience of 5G doesn’t always reach up to the hype — not as of now, at least.

This is mainly because infrastructure (called “spectrum”) has primarily been unavailable and is required to create fifth-generation wireless networks that are visibly faster than 4G and easily accessible across wide geographic areas. That altered with completing the Federal Communications Commission’s latest spectrum auction the previous month, where carriers spent altogether $81 billion to get access to the critical resource.

“Spectrum is the driving force of the network,” stated Craig Moffett, founding partner, and analyst at MoffettNathanson. “The main reason that we don’t have the 5G network that all have been waiting desperately for is we didn’t possess the right spectrum for it.”

To streamline the large level of traffic high-speed 5G networks will transmit, wireless companies need to create highways for that data to travel on. Spectrum is similar to the real estate the US government auctions off for carriers to build those highways — the nicer the property, the more lanes they can build, and the quicker and more accessible their 5G networks.

Last week, Verizon (VZ), T-Mobile (TMUS), and AT&T (T) held meetups to update investors and analysts on the auction outcomes and spread out plans for increasing their networks. (CNN’s parent company WarnerMedia is owned by AT&T.)

“This is a wonderful day for Verizon — I would go so far as to state it’s one of the most important days in our 20-year history,” CEO and Chairman Hans Vestberg were quoted at the beginning of Verizon’s meetup.

There is “no doubt” the carriers’ new spectrum holdings will create better consumers’ experience using 5G, Moffett said. But the carriers hugely expect it will take multiple years to put the new spectrum to use. This spectrum auction was critical.

This spectrum auction enables the carriers, mainly AT&T and Verizon, to fill a keyhole in their 5G networks.

Three categories of the spectrum are required to build 5G networks. High-band, or “millimeter wave” networks give breakneck speeds but restricted geographic coverage. For this specific reason, it only makes sense for carriers to develop high-band networks in highly populated areas like cities and airports, where multiple cell sites can be installed near to each other.”

Low-band spectrum provides much wider coverage, making it efficient for use in nationwide 5G networks, but data speeds are only slightly faster than on 4G LTE.

Mid-band is the “Goldilocks” spectrum that balances speed and coverage, which has mainly been lacking in US 5G networks to date. Carriers bid on the mid-band spectrum in the recent auction, and it didn’t come easy.

Verizon shelled out $52.9 billion to more than two times its mid-band spectrum holdings. The company plans to spend $10 billion more in capital expenditures over the next three years, in addition to its current spending plans, to put the latest spectrum to use.

AT&T bid $27.4 billion to strengthen its mid-band holdings and predicts to spend between $6 billion and $8 billion in extra capital from 2022 to 2024 on the mid-band network buildout.

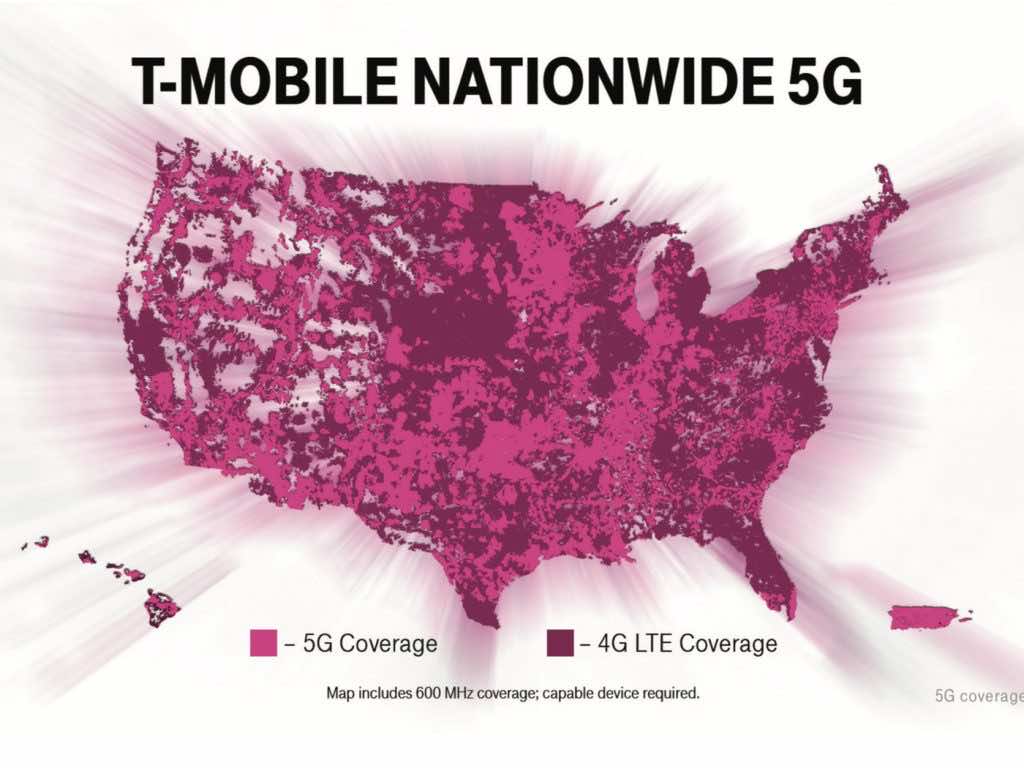

T-Mobile had a benefit from the auction: a note-worthy amount of mid-band spectrum already in its portfolio, credit to its $26 billion acquisition of Sprint last year. As a result, T-Mobile spent just $9.3 billion to cover select gaps in its network.

Its current mid-band spectrum puts T-Mobile in front of rivals, analysts state. While Verizon and AT&T can’t begin building on their recent spectrum holdings until later this year, T-Mobile currently has a mid-band network up and running.

T-Mobile pacing ahead in the 5G business

“T-Mobile succeeded,” Moffett said of the FCC auction. “Their mid-band spectrum position was much better than either Verizon or AT&T’s going in … and they hardly had to spend anything like the same kind of money to maintain that position.”

T-Mobile hopes to cover 200 million people with high-speed 5G by the end of this year. Verizon states it will cover more than 175 million people over 2022 and 2023, reaching a total of more than 250 million people by 2024. And AT&T plans to cover around 100 million people by mid-2023. (Each carrier reaches many more consumers through their broader, though somewhat slower, low-band 5G networks.)

“We planned to go into and come out of the auction with everything. We want to be the leader in the 5g era for the time span of the 5g era,” T-Mobile President and CEO Mike Sievert said to CNN Business. “That’s precisely what we accomplished.”

However, unlike T-Mobile, Verizon and AT&T have existing fiber infrastructure that could support them compete with T-Mobile’s powerful spectrum portfolio.

AT&T’s strategy, for example, is to cover broadband needs “in a hybrid fashion, with fiber being installed in homes, to houses to hospitals to tiny businesses,” AT&T Communications CEO Jeff McElfresh told in an interview. “We are balanced in our investments in spectrum and fiber.”