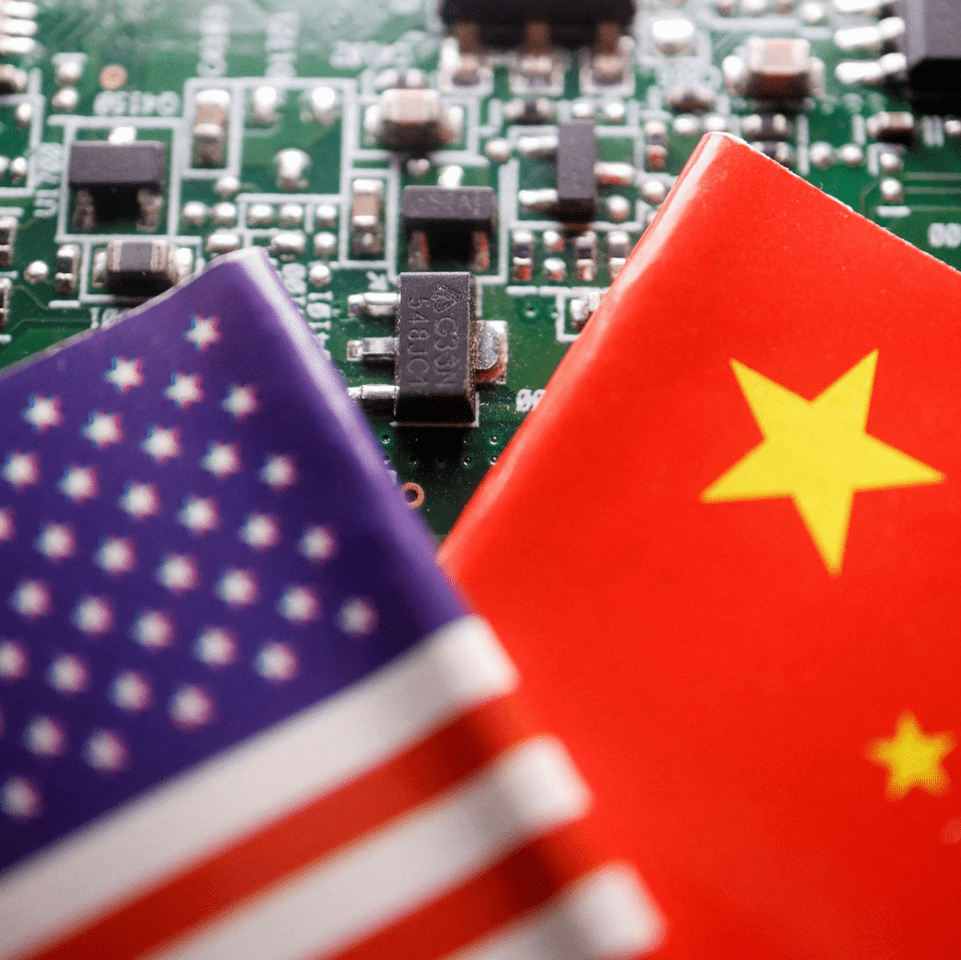

In a significant policy development, President Joe Biden has taken decisive action to impose limitations on fresh U.S. investments within pivotal technological spheres in China. Through the utilization of his executive order authority, President Biden seeks to mitigate the inadvertent allocation of American capital and intellectual resources that could potentially contribute to the augmentation of China’s military capabilities. The focal ambit of this directive encompasses three critical domains: semiconductor and microelectronics, quantum information technologies, and specific artificial intelligence systems.

The executive order confers authority upon the U.S. Treasury Secretary to proscribe or curtail U.S. investments in Chinese corporate entities operating within the aforementioned sectors. The overarching rationale is to forestall China’s potential exploitation of these technological advancements for the purpose of fortifying its military prowess, thereby safeguarding U.S. national security interests. However, the precise contours of these restrictions are subject to refinement, and the draft proposal solicits public input prior to finalization.

The fundamental objective underpinning this directive is the preemptive safeguarding of U.S. security interests by forestalling China’s acquisition of technologies that could potentially pose a threat. This directive encompasses a spectrum of investment modalities, ranging from private equity engagements to collaborative joint ventures and greenfield initiatives.

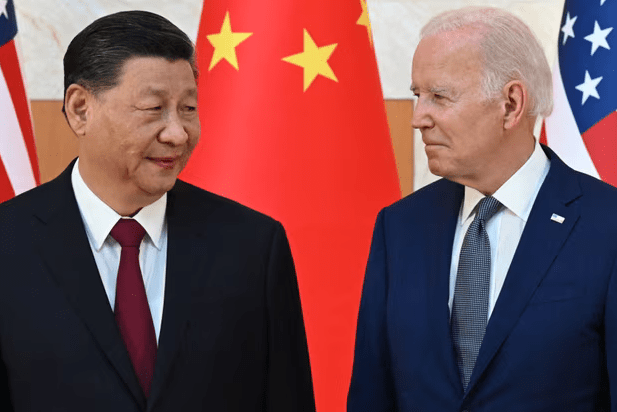

China’s response has been characterized by expressed reservations, contending that these regulations may disrupt customary business operations and exert adverse ramifications on the global economic landscape. The Chinese Commerce Ministry has emphasized the imperative of upholding principles of equitable competition and adherence to market economy protocols, while urging the United States to eschew actions that could encumber international economic exchanges.

In response to the U.S. imposition of investment restrictions, China has articulated its strong objections, unequivocally asserting its standpoint. Furthermore, China has admonished the United States to honor its commitment against disengagement or impediments to China’s economic progress.

The Hong Kong administration has also voiced its disapproval, portraying the restrictions as unbalanced measures that could undermine standard investment and trade activities. The administration contends that these measures may engender disruption within the international economic order and impinge upon the commercial interests of American enterprises, consequently exacerbating uncertainty within the global economic milieu.

President Biden’s executive order primarily revolves around the channeling of investments into Chinese enterprises specialized in the development of computer chip design software and ancillary manufacturing tools. This strategic prerogative aligns with the U.S.’s determination to uphold its technological primacy within these pivotal sectors.

The formulation of this directive has emanated from a consultative process involving allied nations, thereby reflecting a collaborative approach in its development. Notably, President Biden’s administration sought input from the Group of Seven (G7) nations, signifying a concerted diplomatic effort.

It is essential to note that this order pertains exclusively to forthcoming investment endeavors and refrains from impacting pre-existing commitments. Furthermore, there exists the potential for requisitioning information pertaining to prior transactions.

While this directive portends ramifications for U.S.-China bilateral relations, U.S. officials underscore its selective focus on addressing specific security concerns rather than signifying a comprehensive decoupling of the intertwined economies.

Nevertheless, apprehensions have been voiced by some quarters, contending that the order features certain vulnerabilities and falls short of achieving a requisite degree of assertiveness. The order is designed to proscribe specific investment transactions while mandating requisite disclosures for others.

Industry stakeholders within the semiconductor sector express optimism concerning the prospective benefits of this directive, envisioning enhanced parity for U.S. chip manufacturers within global markets, including China’s.

The unfolding narrative surrounding the implementation of this order is anticipated to elicit several pertinent questions. These encompass the prospective impact upon U.S. allies, the Chinese response, and the wider implications for international trade and diplomacy. Consequently, the global community keenly awaits the unfolding of subsequent developments.