The billionaire elite of the world kicked off 2023 with a bang, riding the wave of a powerful market rally that fueled their staggering wealth. In a remarkable feat, the top 500 billionaires collectively amassed an astonishing $852 billion during the first half of the year, equivalent to a jaw-dropping $14 million each day, according to Bloomberg’s Billionaires Index. This phenomenal surge in fortunes marks their best half-year performance since the market rebound in late 2020 after the tumultuous impact of the COVID-19 pandemic. While tech tycoons soared to new heights, not all billionaires basked in this golden era, as some encountered significant losses along the way.

Amidst the glimmers of a new year, the world’s most affluent individuals experienced an unprecedented rise in wealth during the first half of 2023. The figures are staggering, with Bloomberg’s Billionaires Index revealing a collective surge of $852 billion among the top 500 billionaires. This translates to an astounding average increase of approximately $14 million per day, illuminating their unrivaled financial prowess. This extraordinary performance surpasses any other half-year period since the market’s remarkable recovery in the latter part of 2020, signaling a true resurgence after the debilitating impact of the global COVID-19 crisis.

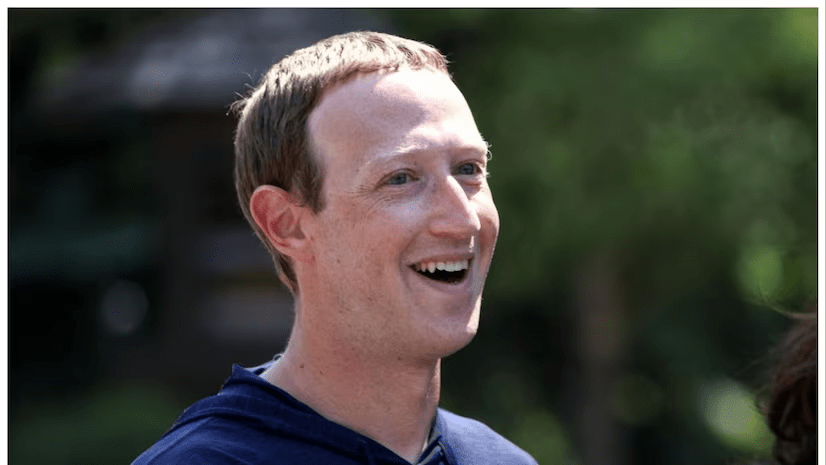

At the heart of this wealth surge lies a sweeping market rally that propelled the fortunes of these billionaires to stratospheric heights. The S&P 500, a renowned index encompassing diverse sectors such as banking, manufacturing, technology, and retail, showcased a remarkable 16.5% surge in value throughout the year. However, it was the realm of technology that truly stole the show. Fueled by the flourishing domain of generative artificial intelligence, tech stocks experienced an extraordinary upswing. The Nasdaq 100, in particular, commanded attention with an impressive 31% rise. Within this arena, two titans of tech, Elon Musk, and Mark Zuckerberg, emerged as the unparalleled victors, claiming their positions at the zenith of wealth accumulation.

Elon Musk, the visionary behind Tesla and SpaceX, as well as the former CEO of Twitter, witnessed his wealth skyrocket by an astonishing $97 billion until June 30, according to Bloomberg’s meticulous calculations. At present, Musk’s net worth towers at an astronomical $237 billion, securing his title as the world’s wealthiest person, surpassing even the illustrious French tycoon Bernard Arnault, CEO and co-founder of LVMH Moët Hennessy Louis Vuitton. The tussle for the crown of the richest individual has been a gripping battle between Musk and Arnault since the latter part of 2022.

Not to be outdone, Mark Zuckerberg, the driving force behind the social media titan Meta, enjoyed his own remarkable ascent. With a nearly 80% surge in Meta’s stock price, Zuckerberg bolstered his net worth by an astounding $60 billion this year. This achievement coincided with Meta’s unwavering focus on optimizing efficiency, marking a significant chapter in the company’s evolution.

Nevertheless, amidst the glittering success stories, there were billionaires who experienced substantial setbacks. Among them, Indian magnate Gautam Adani faced a precipitous decline in his fortune, witnessing a staggering $60.2 billion evaporate. This staggering loss can be traced back to scathing allegations made by US short-seller Hindenburg Research. In a damning report released on January 24, Hindenburg Research accused the Adani Group of orchestrating a brazen stock manipulation and accounting fraud scheme spanning several decades. Adani has vehemently denied these claims, but the impact on his wealth has been undeniable.

As the curtains closed on the financial stage, the S&P 500 ended the day with a modest 0.12% gain, reaching a commendable 4,455.59 points. Similarly, the Nasdaq 100 experienced a slight uplift, closing with a 0.2% increase at 15,208.69 points.