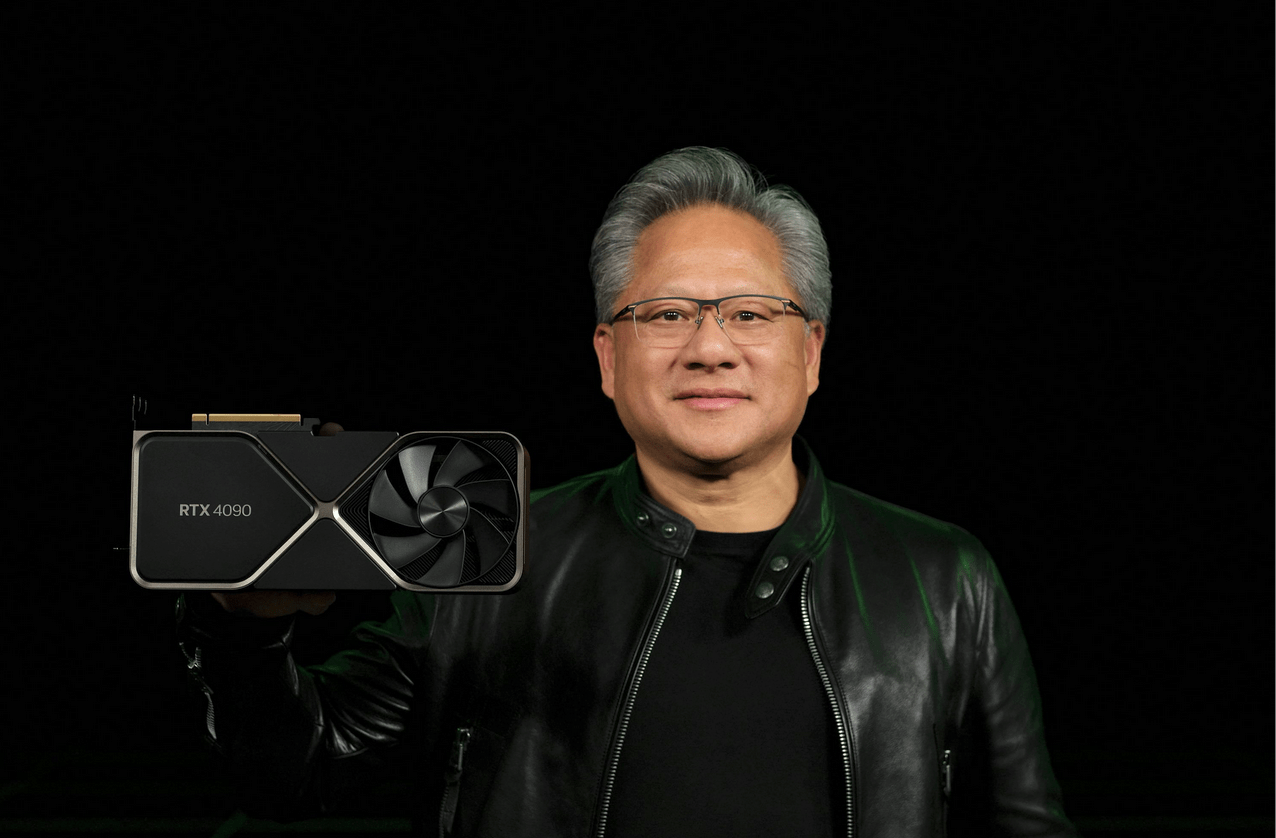

Nvidia, the global chip leader, has unveiled the RTX 4090 D, a new gaming processor designed to comply with US export rules while being exclusively available in China from January. Positioned as offering a “quantum leap in performance and AI-driven graphics,” this move is seen as a strategic effort by Nvidia to navigate US restrictions on high-tech exports to China, safeguarding its dominance in the country’s $7 billion AI chip market.

The RTX 4090 D, however, reportedly exhibits an 11% decrease in performance compared to the original 4090 chip released in late 2022. This reduction is attributed to fewer processing subunits dedicated to accelerating AI workloads. By intentionally offering a less advanced version, Nvidia aims to navigate US regulations and maintain its significant 90% share of the Chinese market, a dominance that faces potential challenges due to US bans on certain exports.

Nvidia’s CEO, Jensen Huang, asserted that the company had been working closely with the US government to ensure compliance with regulations. However, past experiences indicate that finding a solution may not be straightforward.

Nvidia has previously modified GPU chips for the Chinese market, only to witness these new versions being added to the list of banned technologies by the US government. Notably, this highlights the complexities of balancing compliance with market demands and regulatory restrictions.

The broader context involves rising tensions between the US and China, where the latter is aggressively investing in AI development, supported by a substantial $41 billion government fund. Nvidia faces challenges in navigating this geopolitical landscape and ensuring its sustained growth, prompting Huang to explore options like shifting the supply chain to the wider South Asia region. He expressed confidence in Southeast Asia becoming a significant technology hub, indicating potential diversification strategies.

Despite these challenges, Nvidia’s financial performance in the third quarter exceeded expectations, with a revenue surge of 206% to $18.1 billion. The company’s stock has tripled in value throughout the year, surpassing a $1 trillion market valuation, showcasing its resilience amid geopolitical uncertainties.