The world’s leading chipmakers collectively pour billions into research and development each year, but the sheer scale of Intel’s 2024 investment stands out even in this high-spending sector. According to company filings and an analysis by TechInsights, Intel spent $16.546 billion on R&D last year, surpassing competitors AMD, Nvidia, and even South Korea’s Samsung Electronics.

For perspective, Nvidia reported R&D spending of $12.914 billion, while AMD invested $6.456 billion. Samsung, the nearest non-U.S. rival, spent about $9.5 billion. Intel’s outlay represents a 28% increase over Nvidia and a staggering 156% more than AMD.

On raw dollars, Intel dominates. But when measured against revenue, the picture changes dramatically. Intel devoted 31% of its net revenue to R&D, compared to 26% for AMD, while Nvidia managed just 10% and Samsung only 4%. Nvidia’s relatively low percentage reflects its immense profits from AI chips, which have made the company one of the world’s most valuable firms.

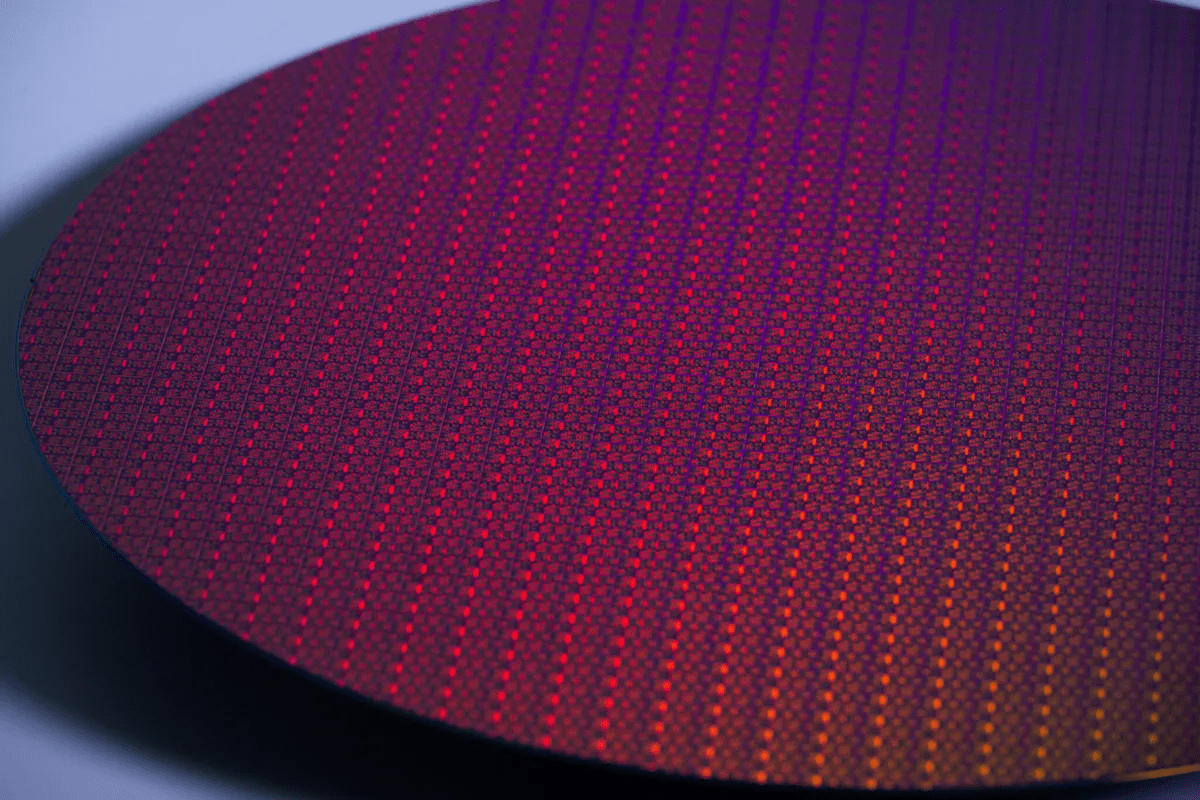

Intel’s massive spending is partly explained by its investment in advanced manufacturing, particularly its 18A process node, as it seeks to reestablish leadership in semiconductor fabrication. The company has been trimming projects and divisions to cut losses, but its broad product portfolio from CPUs and GPUs to software and foundry services demands enormous R&D resources.

AMD, by contrast, outsources chip manufacturing to foundry partners like TSMC, freeing it to focus most of its $6.5 billion R&D budget on CPU, GPU, and accelerator design, as well as the software that supports them. This strategy has paid off, with Ryzen CPUs and Radeon GPUs continuing to gain traction against Intel and Nvidia.

Nvidia, meanwhile, has been reinvesting its booming AI-driven revenues into GPU and data center development. Its need to maintain dominance in AI, while fending off growing competition, suggests its R&D spending could soon outpace Intel’s.

Intel’s current CEO, Lip-Bu Tan, may seek to trim R&D costs in 2025, but industry watchers expect the company to remain one of the sector’s biggest spenders. With its Arrow Lake CPUs receiving lukewarm reviews and Nova Lake positioned as a make-or-break launch, Intel’s heavy R&D bets will need to deliver.

Nvidia, flush with AI profits, looks likely to top the R&D spending tables by the end of 2025, while AMD and Intel remain constrained by narrower margins and, in Intel’s case, recent financial losses.

What all of these companies share, however, is a refusal to cut back on core product research. For AMD and Intel, CPUs remain the backbone of their businesses, while Nvidia’s fortunes rest on GPUs and AI accelerators. Samsung, though more diversified, continues to invest heavily in semiconductors as a strategic pillar.

In an industry defined by rapid innovation, one thing is clear: scaling back R&D is not an option.