The development of robots has been ongoing for over a decade. Their potential to perform tasks faster and more accurately than humans has made them a key focus, particularly in recent years.

Some hotels in Japan are already using robot staff, while many digital companies are making use of AI technology to automate certain tasks and services. So, how soon can we expect robots in other sectors, such as financial services?

Could robots replace financial professionals?

As work is being done to develop more advanced AI systems in the financial sector, could that spell the end of human financial professionals? According to experts in the sector, the answer is no.

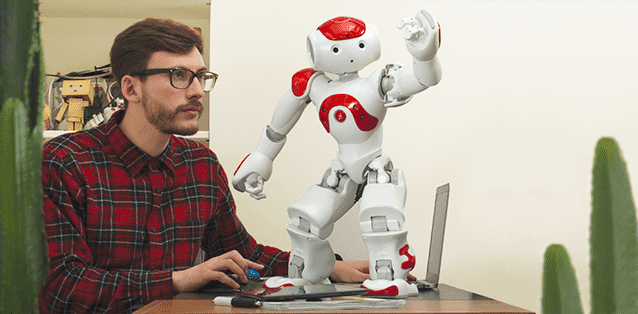

While robotic technology might be able to eliminate the need for financial professionals in certain tasks, it’s not going to be capable of carrying out all tasks by itself. So, rather than taking over, robots will simply be used to work alongside financial professionals.

Are they already in the banking sector?

While you might not realise it, robots are actually already in the financial sector. AI technology is helping banks and financial institutions to automate numerous processes, such as mortgage application approval and cost accounting.

They’re also in the credit industry, with companies such as Liberis, using AI technology for fast credit approvals. If you apply for a loan through an online lender for example, you’ll see you can often get a decision in less than a minute. This is all thanks to AI technology which uses algorithms to determine your eligibility.

So, robots are already being used within the banking and financial sector, just not how you might imagine.

What impact could they have?

There are several benefits robots bring into the financial sector. One of the main ones is how quickly tasks can be processed. What would take a human thousands of hours to review, would take a robot seconds. Similarly, there would be fewer errors made with robotic technology. Any errors in the banking sector can be catastrophic so reducing the risk of error can only be a good thing. They could also reduce transaction time, giving faster access to our accounts and finances.

So, while robots can be a real asset in the financial sector, they are unlikely to take over. Humans will still be needed in the future; robotic technology will just help to make the job of financial professionals easier. Robots are already in the financial services sector and in the next 5-10 years, they’re likely to keep getting smarter.