In the semiconductor race, Nvidia often dominates headlines, while Chinese competitors also draw attention for their efforts to catch up. Yet, a quieter but more significant challenge may be coming from closer to home: Alphabet Inc., Google’s parent company, is rapidly positioning itself as a formidable rival in AI hardware. Analysts at D.A. Davidson argue that Google could represent “the best alternative” to Nvidia, with a potential business opportunity valued at nearly $900 billion.

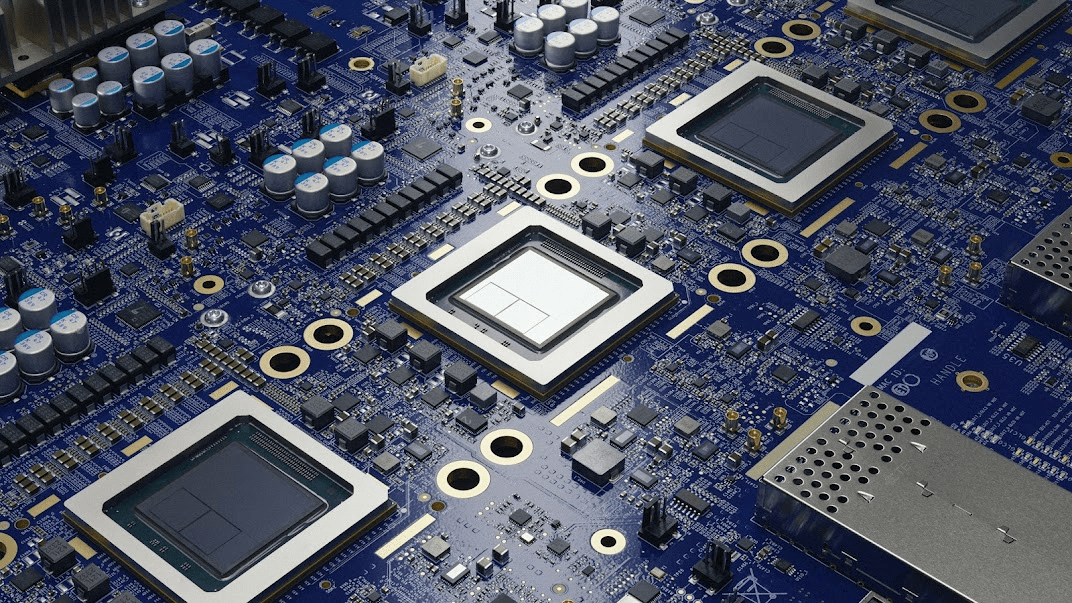

D.A. Davidson analysts, led by Gil Luria, point to strong momentum around Google’s tensor processing units (TPUs), custom-designed accelerators built for AI and machine learning. After conversations with researchers and engineers at top AI labs, they noted an overall “positive sentiment” toward Google’s hardware.

The analysts suggest that if Google were to combine its TPU business with its DeepMind research arm into a spinoff, it could unlock extraordinary value. As they explained: “Should this business ever be spun-off, investors would be getting a leading AI accelerator supplier and frontier AI lab in one, making it arguably one of Alphabet’s most valuable businesses.”

Earlier this year, the team had valued such a venture at $717 billion but has since raised the estimate to $900 billion.

Google’s sixth-generation Trillium TPUs, released in December, are already in strong demand. Analysts expect interest to “dramatically increase” with the upcoming seventh-generation Ironwood TPUs, designed for large-scale AI inference. Capable of scaling up to 42.5 exaflops and offering more efficient memory capacity, these chips are also “significantly more cost-efficient,” making them attractive to frontier labs.

Startups like Anthropic are exploring wider TPU adoption, with hiring moves suggesting a shift away from Amazon’s Trainium hardware. Meanwhile, Elon Musk’s xAI is reportedly interested in TPUs due to improved JAX-TPU tooling, which makes it easier for outside developers to run advanced AI programs on Google’s chips.

Currently, Google partners exclusively with Broadcom for TPU production, but reports indicate it may also bring in MediaTek, taking advantage of its ties to TSMC and lower production costs.

Developer engagement is growing as well, Google Cloud saw a 96% surge in TPU-related activity between February and August, according to D.A. Davidson’s dataset.

Despite the excitement, analysts remain cautious. While a major breakup of Alphabet could unlock massive shareholder value, they see it as unlikely in the near term. For now, they maintain a neutral stance on Alphabet’s stock, with a revised price target of $190, absent “the consideration of a breakup.”