During his most recent visit to the “Joe Rogan Experience” podcast, Elon Musk, the CEO of Tesla, gave a status report on the Cybertruck’s manufacturing stats. During the production phase, Musk stated that Tesla hopes to produce roughly 200,000 Cybertrucks annually, albeit that amount may be exceeded. But he also noted that the production process is significantly more difficult than the original concept, highlighting how difficult it will be to commercialize the ground-breaking electric vehicle.

Musk did not provide a timeframe for reaching this production goal, but his most recent estimate is a major increase over the company’s previous estimate from October, which suggested that over 125,000 Cybertrucks might be produced annually during the pilot program.

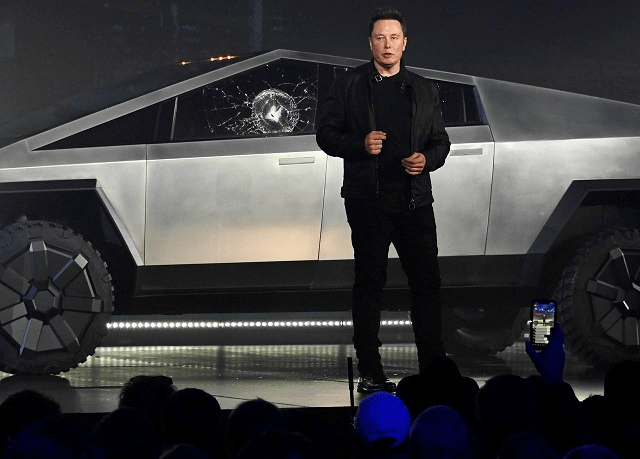

The Cybertruck has been a long-anticipated addition to Tesla’s lineup, with the first deliveries finally expected to begin this month after facing a series of delays over the past two years. These delays were attributed to design changes and feature modifications. The Cybertruck was initially unveiled by Tesla in November 2019, and it quickly garnered significant attention, amassing 250,000 pre-orders within days of the announcement. The starting price for the unique, trapezoidal vehicle was initially quoted at $39,900, though the current price remains undisclosed.

During his podcast appearance, Musk also provided more details about the Cybertruck, including the existence of a “beast mode version.” This high-impact model will feature bulletproof steel panels and the option for bulletproof glass for the windows, adding to its already impressive array of features.

Musk’s acknowledgment of the challenges associated with Cybertruck production echoes his previous statements. He noted that developing such a groundbreaking vehicle requires a staggering amount of effort, primarily because it is a pioneering design with no established reference points for copying. In a prior Tesla earnings call, he described the project as “radical and innovative” and acknowledged the difficulties arising from its unprecedented nature.

On the day of the podcast, Tesla’s share price closed 1.8% higher at $200.84 a share, suggesting that the market was reacting favorably to this news. The company’s stock has increased in value by 63% over the course of the year, despite manufacturing issues. This indicates that people are still interested in and confident in Tesla’s revolutionary approach to electric cars, which includes the much anticipated Cybertruck.