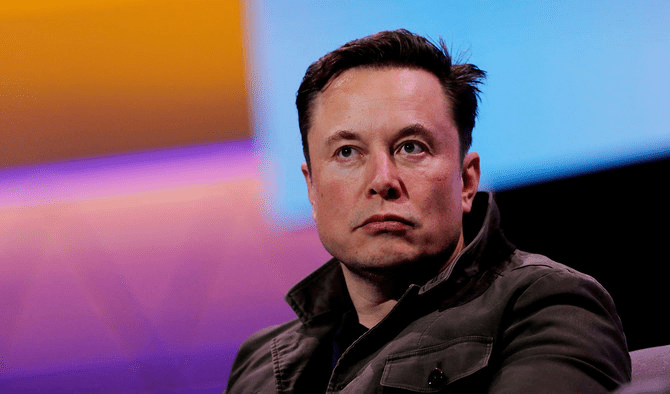

The mysterious CEO of SpaceX and Tesla, Elon Musk, has sparked controversy once more with his recent remarks about his ownership position in the company. In an odd declaration, Musk voiced his displeasure with his present ownership position in the electric vehicle manufacturer and alluded to his need for more power.

The fact that Musk recently sold billions of dollars’ worth of Tesla stock to buy Twitter—a move that caused some controversy in the financial community because of the social media platform’s alleged overvaluation—makes this statement especially odd. The announcement that Musk would invest in Twitter spurred conversations about his possible new CEO salary package.

Remarkably, these discussions took place at the same time that Tesla decided to reduce its own employee stock option program, a move that was noted by industry watchers. Although there is a general opinion that Musk should be paid fairly for his work as CEO, his current 13% investment in Tesla, or 411 million shares, is thought to be enough to motivate him to push the firm toward success. Nevertheless, Musk maintains that in order to have more sway over Tesla’s robots and AI initiatives, he needs a larger stake—roughly 25% of the voting power. He even went so far as to say that unless his vote control improves, he would prefer to manufacture things outside of Tesla.

This peculiar situation arises from Musk’s tumultuous financial moves in recent years, particularly his botched acquisition of Twitter. Musk initially promised to sell 10% of his Tesla stake through a Twitter poll, ostensibly to address concerns about the wealthy avoiding taxes on unrealized gains. The resulting stock sale funded his foray into Twitter and, subsequently, a failed attempt to take the platform private.

Concerns concerning Musk’s devotion to the electric vehicle firm and his priorities were brought up by the aftermath from his financial antics, which included selling off a sizable portion of Tesla shares to finance the purchase of Twitter. Critics contend that given his recent remarks and conflicting interests, Musk’s future for Tesla is worrisome.

Amidst legal difficulties about exorbitant compensation schemes and disgruntled shareholders, Musk and Tesla are facing scrutiny over the eccentric CEO’s inclination to develop AI technologies outside of Tesla. Musk’s already unorthodox leadership style becomes even more problematic when considering the perceived conflict of interest between his positions at Tesla and his independent AI business.

While some propose a new CEO compensation plan for Musk that includes significant annual TSLA shares with a unique twist—deductions for contentious tweets—the main question still stands: Can Musk successfully lead Tesla in the face of competing priorities, or does the company’s long-term success require a reevaluation of leadership? Investors and industry observers are keeping a close eye on the ongoing story of Elon Musk and Tesla.