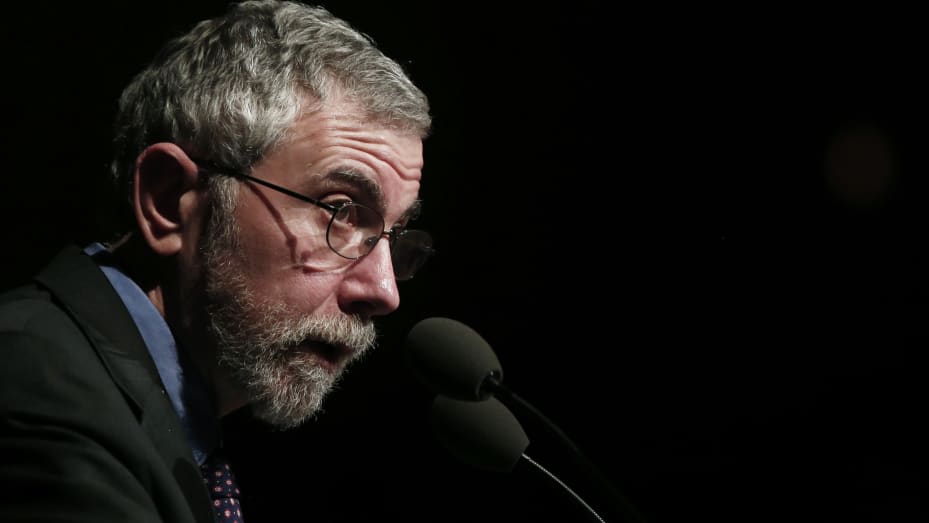

In an editorial post published in the New York Times, longtime crypto sceptic and Nobel Prize-winning economist Paul Krugman linked the latest cryptocurrency fall to the subprime mortgage debacle.

“I’m seeing uncomfortable parallels with the subprime crisis of the 2000s,” the economist said about the crypto market, which has lost $1.3 trillion market value over the few last weeks.

“No, crypto doesn’t threaten the financial system — the numbers aren’t big enough to do that,” he wrote.

“But there’s growing evidence that the risks of crypto are falling disproportionately on people who don’t know what they are getting into and are poorly positioned to handle the downside.”

A big housing bubble fuelled by poor mortgage lending rules crashed, resulting in a rush of mortgages, foreclosures, and widespread downgrades of mortgage-backed securities sold by the top lenders. As a result, many borrowers eventually lost their houses, while investors who purchased these soured mortgage bonds, including pensions and retirement plans, were left holding the bag.

According to Krugman, there is a similar dynamic in action at the crypto market, and investors are often swept up in the excitement without fully realising the risks involved.

While stock investors tend to be educated, roughly 55% of crypto traders do not have a degree, according to the economist, citing a NORC report. Similarly to 2007, when the least eligible borrowers were given the most complicated loan packages, it appears that the riskiest financial assets are being pushed to the least skilled or most susceptible investors today.

Krugman, who has previously stated that bitcoin is a more transparent bubble than housing, challenged NORC’s argument that digital assets pave the way for more diversified investors.

“I remember the days when subprime mortgage lending was similarly celebrated — when it was hailed as a way to open up the benefits of homeownership to previously excluded groups,” he wrote.

“It turned out, however, that many borrowers didn’t understand what they were getting into.”

While the Nobel Laureate stated that he does not anticipate cryptocurrency would cause a severe economic disaster in the same manner that subprime mortgages did, he did provide an unsettling warning:

“If you ask me, regulators have made the same mistake they made on subprime: They failed to protect the public against financial products nobody understood, and many vulnerable families may end up paying the price.”