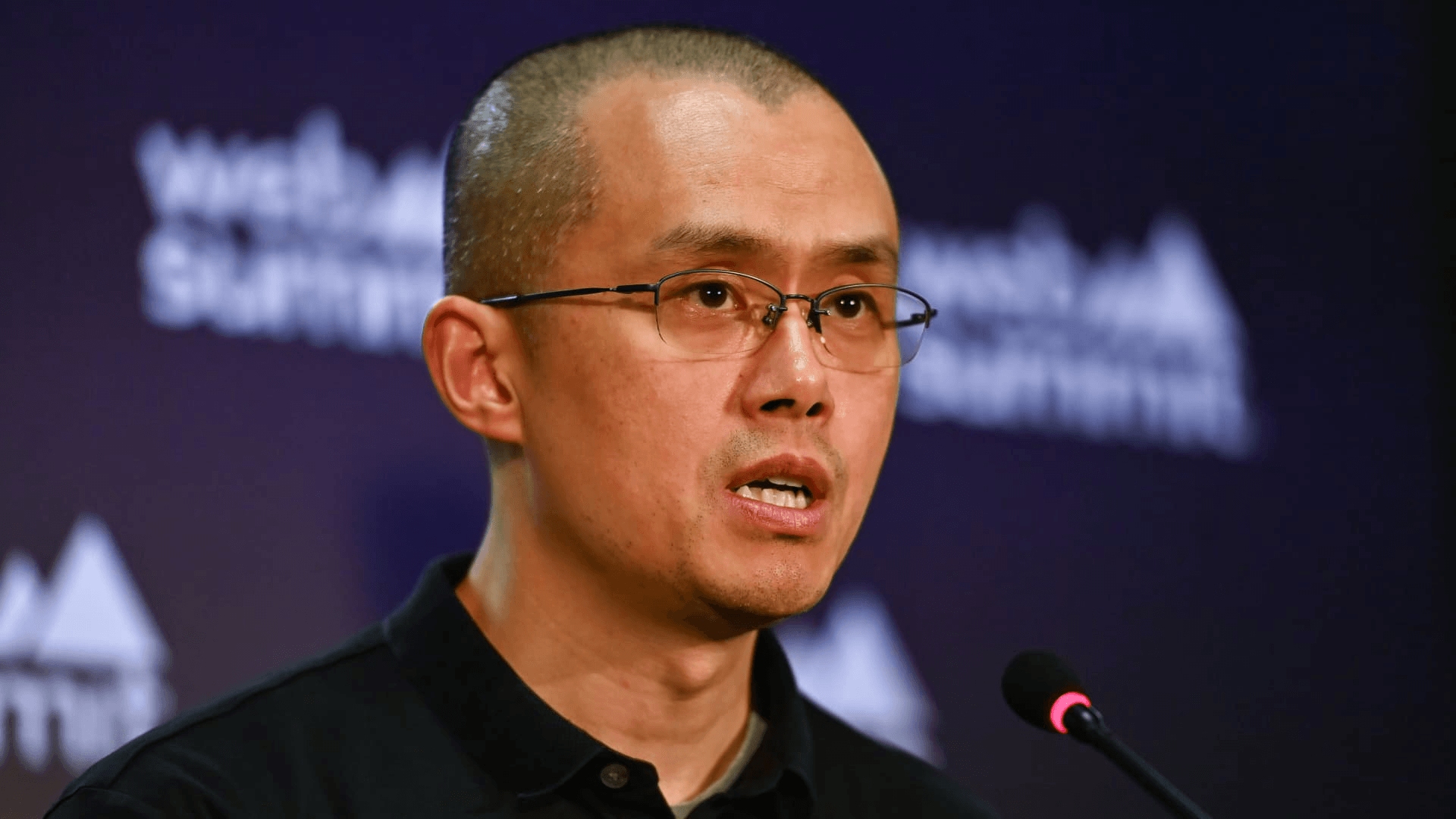

In a seismic shift for the world’s largest cryptocurrency exchange, Binance, users withdrew over $1 billion within 24 hours of CEO Changpeng Zhao stepping down and pleading guilty to multiple charges. Data from blockchain analysis firm Nansen revealed the substantial outflows, excluding bitcoin.

The departure of Zhao, who founded Binance in 2017, follows a plea deal with the U.S. Department of Justice (DOJ). This development triggered a drop of 25% in liquidity as market makers scaled back positions, according to data from Kaiko.

This is not the first time Binance has faced significant challenges. Earlier, the exchange and its founder were charged with 13 securities violations by the Securities and Exchange Commission (SEC), leading to a similar withdrawal trend and an 8% decline in Binance’s native token, BNB, in the last 24 hours.

Despite the turbulence, Binance remains the world’s largest crypto exchange, handling billions in annual trading volume. The recent agreement with the DOJ requires Binance to pay $4.3 billion in fines, ending a lengthy investigation into its operations.

Assets totaling over $65 billion still reside on the platform, suggesting Binance’s capitalization can withstand the recent investor exodus. While withdrawals have surged, a “mass exodus” has not yet occurred.

Market analysts remain cautiously optimistic about Binance’s future, highlighting the company’s compliance efforts and the substantial assets within its reserves. The $4.3 billion fine, while significant, is not anticipated to jeopardize Binance’s solvency.

The new CEO, Richard Teng, formerly of Abu Dhabi’s financial services regulatory body, faces the task of steering Binance through this challenging period. Experts suggest that, with the regulatory dispute resolved, the company’s commitment to enhancing security measures and the potential approval of a Bitcoin ETF could positively impact the crypto market in the long term.

Binance’s reserves are expected to undergo scrutiny, prompting questions about the exchange’s internal governance and risk management. With competitors like Coinbase, Kraken, and OKX potentially looking to capitalize on Binance’s situation, the cryptocurrency industry braces for a period of increased scrutiny and competition.