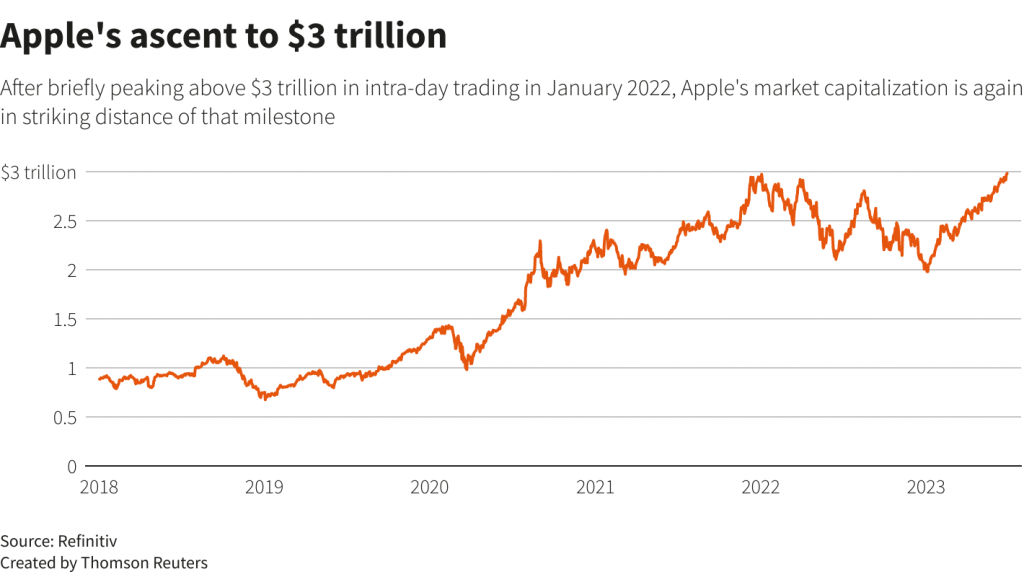

Apple Inc’s stock market value reached a significant milestone on Friday, surpassing $3 trillion for the first time. This achievement was driven by positive signs of improving inflation and optimism surrounding Apple’s expansion into new markets.

The company’s shares experienced a 2.3% surge, closing at $193.97 and resulting in a market capitalization of $3.05 trillion. This marked Apple’s fourth consecutive record high close and showcased its dominance in the global market.

The rise in Apple’s stock value was part of a broader trend among heavyweight growth stocks. Other prominent companies like Nvidia Corp and Tesla Inc also saw substantial increases following a report from the Commerce Department indicating a lower increase in the Personal Consumption Expenditure price index in May compared to April. This data showcased progress in the Federal Reserve’s efforts to combat inflation, further boosting investor confidence.

Throughout 2023, Apple has experienced a remarkable 49% surge in its stock price, outperforming many other valuable companies on Wall Street. This rally has been fueled by the belief that the Federal Reserve’s interest rate hikes are approaching their end, as well as optimism surrounding the potential of artificial intelligence.

Despite Apple’s most recent quarterly report showing a decline in revenue and profits, the results still exceeded analysts’ expectations. The company’s consistent track record of stock buybacks and solid financial performance has solidified its reputation as a safe investment amidst global economic uncertainties.

Art Hogan, the chief market strategist at B. Riley Wealth, commended Apple’s accomplishments, stating, “It’s a testament to one of the greatest publicly traded companies that’s ever existed. It continues to grow and diversify its revenue streams, has shareholder-friendly management, buys back shares, throws off a dividend and has a fortress balance sheet with strong and defendable cash flows.”

Apple’s achievement of reaching a $3 trillion market capitalization comes shortly after the introduction of its augmented-reality headset on June 5. Considered a risky venture akin to the launch of the iPhone over a decade ago, this new product has contributed to a 7% increase in Apple’s stock value. In comparison, the S&P 500 has only risen by 4% during the same period.

Apple’s recent stock gains have exceeded analysts’ estimates for the company’s future earnings. It is currently trading at a price-to-earnings ratio of over 29, the highest since January 2022, highlighting investors’ confidence in its growth potential. In contrast, the median PE ratio for the S&P 500 technology index stands at approximately 13.

Alongside Apple, four other U.S. companies—Alphabet Inc., Amazon.com Inc, Nvidia, and Microsoft Corp—have market valuations exceeding $1 trillion. Notably, Microsoft follows closely behind Apple with a market value of $2.5 trillion. Tesla and Meta Platforms Inc have also seen significant increases, with their shares more than doubling this year. Additionally, Nvidia’s shares have skyrocketed by 190%, propelling the chipmaker into the exclusive trillion-dollar club.

Apple’s attainment of a $3 trillion market capitalization underscores its position as an industry leader and a force to be reckoned with in the global market. With continued innovation and diversification, the company remains poised for further growth and success in the future.