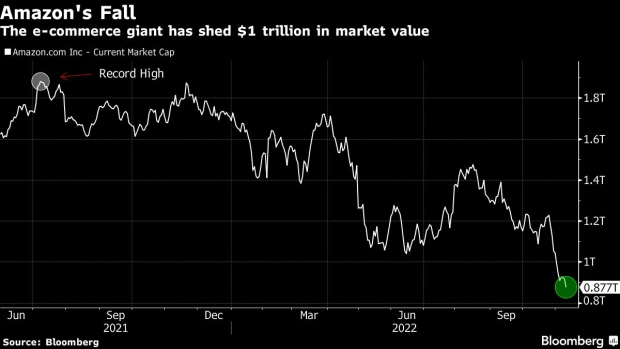

Amazon is now the first public company ever to face a loss of $1 trillion in market value during the tech stock rattle, according to Bloomberg.

On Wednesday, the world’s largest online retailer’s share price closed 4.3% lower at $86.14 which made the market capitalization about $879 billion.

48% of the stock’s value has been lost this year only.

On November 1, Amazon’s market value was recorded to be lower than the $1 trillion mark. This happened just a couple of days after the company had published mixed third-quarter earnings. The data demonstrated the company experiencing the most sluggish fourth-quarter growth ever.

It is quite intriguing to note that it is not just Amazon that is facing this unfortunate scenario. The top five US tech companies by revenue have already lost almost $4 trillion in market value so far this year.

“We are seeing signs all around that, again, people’s budgets are tight, inflation is still high, energy costs are an additional layer on top of that caused by other issues,” Amazon CFO Brian Olsavsky told the reporters in a call on October 27, per Reuters. “We are preparing for what could be a slower growth period, like most companies.”

The descent in Amazon’s share price proved to directly affect the net worth of its founder, Jeff Bezos. He is the world’s fourth richest person now worth $113 billion after starting the year at $192.5 billion, says the Bloomberg Billionaires Index.