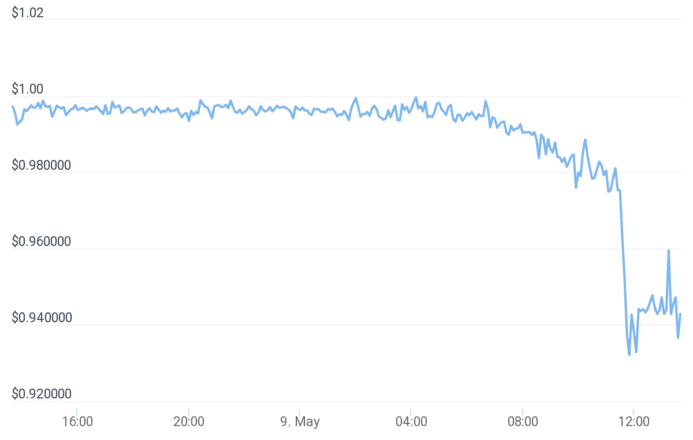

According to CoinMarketCap data, TerraUSD stablecoin (UST), the third-largest stablecoin by market cap, fell to an all-time low of $0.69 in Monday trading yet after Terra’s Terra Foundation Guard provided a $1.5 billion loan to prop up the currency. Additionally, the quoted price on Coinbase dropped as low as $0.65.

Terra is a blockchain network with its own stablecoin, UST, based on the dollar. Unlike USDC and Tether, which are purportedly backed by cash and bank assets, the UST stablecoin is supposed to maintain 1:1 parity with the US dollar through an algorithmic relationship with Terra’s sister coin LUNA. Minting LUNA necessitates the burning of UST, and arbitrage opportunities should keep UST as near to $1 as possible.

Traders can rush and buy at a discount, then sell for $1.00 and keep the difference if the price falls to $0.99. The free market handles all of the work, so supposedly, the order is restored. However, given the greater crypto market crisis over the last few days, the Luna Foundation Guard (LFG), co-founded by Terra co-creator Do Kwon, was skeptical that this would work.

As a result, LFG decided to adopt a fallback strategy that it had been exploring for several months. It has more than $4 billion in Bitcoin, Avalanche, UST, and LUNA reserves as of May 3, which it could utilize if the algorithm failed.

As the stablecoin’s price peg fell to $0.985 this weekend, the stablecoin voted to lend $750 million in Bitcoin and $750 million in UST to defend the security of the $UST peg and the Terra economy, particularly in the face of legacy extreme volatility. The whole point of having a reserve of Bitcoin and other cryptocurrencies was for this exact reason. The solution, however, has had little benefit.

The entire purpose of keeping a reserve of Bitcoin and other cryptocurrencies was for this very occasion. However, this approach has yet to make a difference.

LFG, one of the single largest Bitcoin holdings, blasted much more than on the open market as the price plummeted too low for leveraged traders to pay their bets, amounting to nearly $250 million in liquidations in the last 12 hours.

The near-term stability of the crypto economy, rather than Terra’s long-term stability, may be jeopardized.