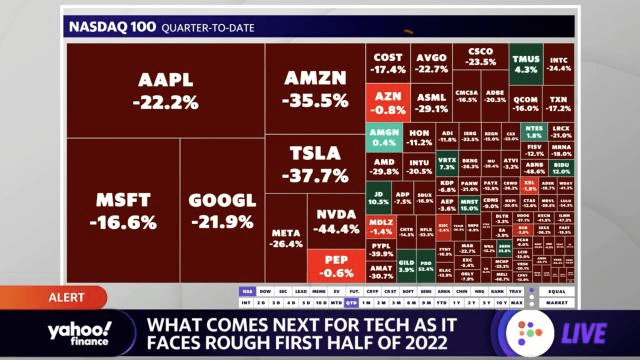

Tech stocks have just had an awful time. The sell-off in the market was so widespread that most companies lost billions or millions of dollars in market capitalization.

The tech-heavy Nasdaq Composite Index has lost nearly twice as much as the broader S&P 500 Index, highlighting the market’s lopsided tilt toward the tech sector.

The economy certainly plays a role in the IT meltdown, but it cannot be held solely responsible. Between 2016 and 2021, tech stocks went on an extended bull market, pushing many shares’ valuations to unsustainable extremes. Amazon, Meta, and Tesla have all lost at least half of their value among the mega-cap tech stocks.

Despite the damaging and financial losses, one company continued to thrive.

Outperforming all other American IT companies in 2022, Super Micro Computer shares have gained by 89 percent. Its market value has increased from $2.4 billion at the beginning of the year to $4.4 billion at present.

Businesses use the computers Supermicro designs and sell as servers for websites, data storage, and software like artificial intelligence algorithms. By making it simpler for customers to customize their PCs, the company has tried to stand apart in the sector.

And the approach has been effective. Supermicro reported a 46 percent increase in revenue to $5.2 billion for its fiscal year 2022. Earnings per share increased from $2.09 in 2021 and $1.60 the year before to $5.32 in 2022. Supermicro’s Tuesday closing price was $82.89.

Supermicro’s shares began to soar in July after the company’s annual profit report was published in August. Sales for Supermicro grew by another 30% in November after increasing by nearly 80% year over year for the September quarter to $1.85 billion.

Building servers requires assembling a variety of components. Supermicro begins with one of its motherboards, inserts an Intel, AMD, or Nvidia processor or graphics processor, and then adds a power supply, RAM, networking, and any additional components the computer may require. The client can purchase the motherboard, a fully built server, or an entire rack of servers from Supermicro.

The picture for the server market in 2023 is pretty fuzzy, particularly in the beginning. Companies will likely cut back on capital expenditures due to their financial constraints. As a result, the revenue growth for Supermicro is anticipated to slow to roughly 32 percent in fiscal 2023 and 9 percent the following year.

According to Supermicro CEO Charles Liang, the business’s recent performance reflects its scale and capacity to provide a greater range of products, notably in the customization area.

Liang noted that although the business has been growing quickly in Taiwan, one element of its differentiating strategy is its San Jose, California, headquarters, where Supermicro continues to carry out the majority of its manufacturing.

In the latest quarter, 45% of Supermicro’s revenue came from enterprise sales, including AI and machine learning products.

In addition, Supermicro is focusing on the niche market of servers for 5G or telecom applications, using a cutting-edge strategy called OpenRAN.

In the fiscal year 2024, Supermicro projects $8 billion to $10 billion in revenue. The business asserts that to accomplish that, it will require significant growth from AI products and a greater availability of complete systems, such as servers that are already mounted in a rack.

Supermicro’s large data center business is driving current growth, according to a November note from Wedbush analyst Matt Bryson.

Supermicro reported in November that a sizable, anonymous customer was responsible for about 22% of the company’s sales during the quarter. In addition, no one client accounted for more than 10% of Supermicro’s sales in recent years.

Analysts are unconvinced that the company would be able to achieve its goals in a more rapidly changing marketplace.

Hosseini from Susquehanna recently downgraded the company. He declared, “I believe they’ll face headwinds in the next year, and the growth plans are too aggressive.”