Your smartphone has a range of apps to keep track of your driving. You can use the stats and brag to your friends what a good driver you are. These drive-tracking apps take data from your accelerometer, GPS and gyroscope in your smartphone and detect your braking and racing frequency. A speedy drive or a sharp turn, your smartphone knows it all.

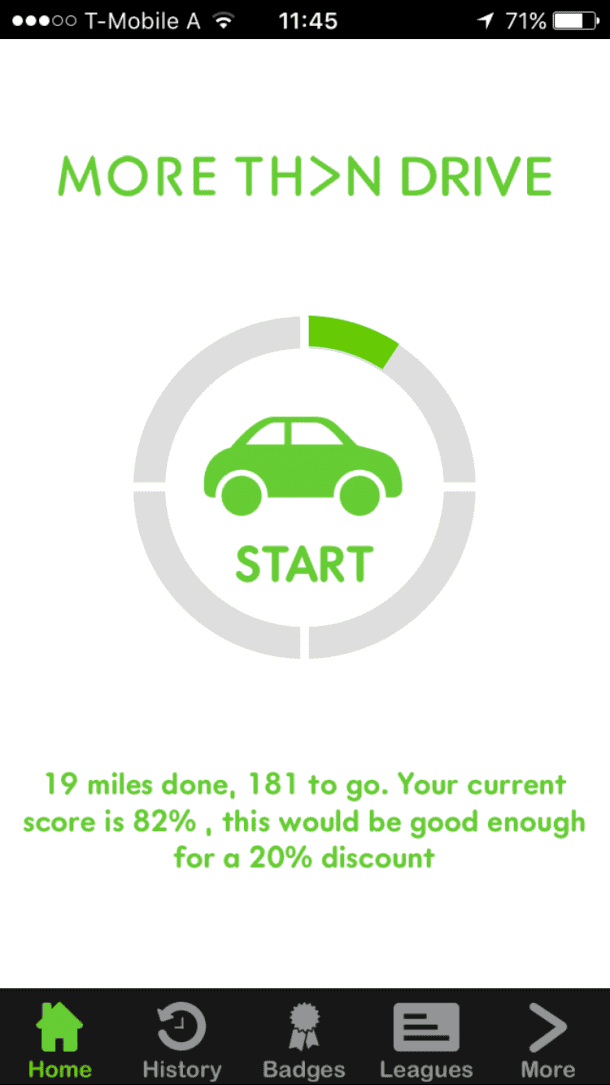

So why is it important? Well insurance companies are pretty interested in the data collected by these apps. This allows them to assess what type of driver you are and how susceptible are you to accidents. And guess what? Good drivers get a higher discount with the insurance companies!

This policy is adopted by US based insurance companies like Allstate, State Farm, Liberty Mutual and Progressive. Get your car insurance discount at submitting the driving data in your smartphone app as it is believed to be a good indicator of the probability of a crash. Progressive, after analyzing about 15 billion miles of its drivers’ data, has concluded that data from drivers’ smartphones is twice as reliable as traditional insurance rating variables.

“Smartphone apps are the biggest innovation the insurance industry has seen in a decade. It changes the whole way insurance works,” said Anton Ossip, CEO of Discovery Insure.

What are these traditional rating variables for car crash insurance? You need the driver’s age, gender and location to formulate the risk of a crash. Not only does the smartphone app data help you get insurance at reduced rates but some believe it also encourages a safe driving behavior.

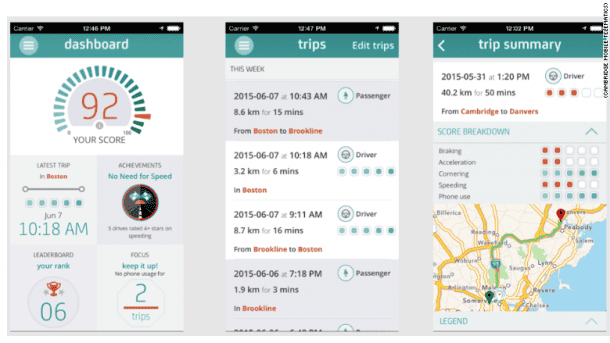

“Safe drivers are made, not born,” said founder of Cambridge Mobile Telematics, Hari Balakrishnan. ” With the right kind of information, feedback, incentives, rewards and games with leaderboards, people can actually become better drivers.”

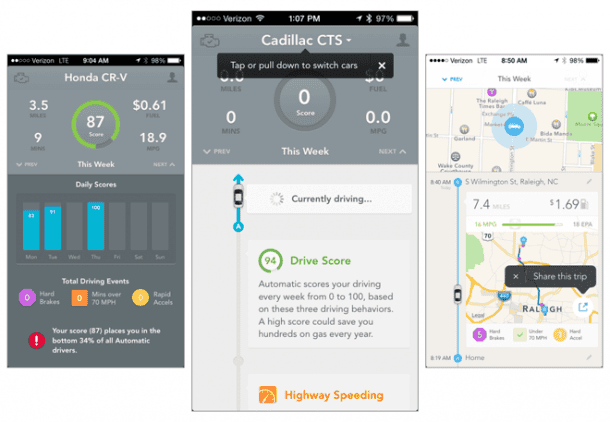

Every customer for State Farm, who signs up for insurance gets a minimal discount; let’s say in case of Drive Safe & Save insurance the rate is 15%.

“Even if you’re the worst driver in the world, you’re still going to get a minimal discount,” says Scott Bruns, State Farm’s Director.

The SmartRide program offers a 10% minimal discount but if you submit your driving scores, you can even get additional 30% off. Some companies suggest that drivers who keep track of their driving via smartphone apps, tend to become better, safer drivers. EverQuote’s Everdrive app users are rated on 5 different parameters: speeding, accelerating, phone use, cornering and braking. The use of this app has shown 31% improvement in driving. This data was based on four-month use of Everdrive app by 25,000 drivers with more than 30 million miles tracked.

“While they are not a magic bullet, we are supportive of their use,” said director of Governors Highway Safety Association, Jonathan Adkins. “It’s very difficult to reach drivers and change behavior so we’re in favor of the kitchen sink approach — anything and everything.”

Also, the data of these apps have not been used for crashes yet but it shows promise. Are you a good driver? Do you have your app data to prove it? Send us a screenshot!