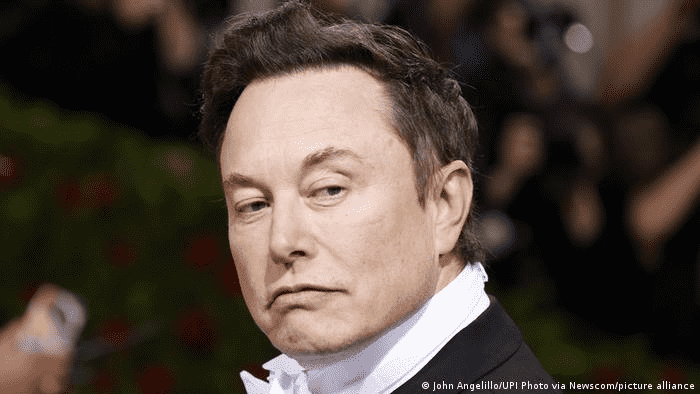

In an unexpected turn of events, Elon Musk reportedly sent a letter to Twitter’s board on Friday stating that he is discontinuing the deal with Twitter. Moreover, the repercussions were followed by a 5% drop in Twitter shares to $36.81 on Friday. Along with that, Tesla’s shares mounted up from 2.5% to $752.29. This $44 billion deal by Musk to buy Twitter is coming to an end, but Twitter doesn’t seem to welcome this statement as the chairperson of Twitter’s board, Bret Taylor, expressed his response by tweeting; “The board is committed to closing the transaction on the price and terms agreed upon with Mr. Musk and plans to pursue legal action to enforce the merger agreement. We are confident we will prevail in the Delaware Court of Chancery. “

Musk, who has more than 100 million followers on Twitter, expressed disappointment about the platform and that the company is not living up to his expectations in terms of free speech. The letter to terminate the deal with Twitter was written by Musk’s lawyer, Mike Ringler, who stated that Musk was continuously monitoring the data related to “fake or spam” accounts on Twitter.

He stated in the letter, “Twitter has failed or refused to provide this information. Sometimes Twitter has ignored Mr. Musk’s requests, sometimes it has rejected them for reasons that appear to be unjustified, and sometimes it has claimed to comply while giving Mr. Musk incomplete or unusable information.” On the other hand, Daniel Ives, who is a Wedbush analyst, sent a note to the platform’s investors after the letter was issued.

He stated, “From the beginning, this was always a head-scratcher to go after Twitter at a $44 billion price tag for Musk and never made much sense to the street. Now it ends (for now) in a Twilight Zone ending with Twitter’s board back against the wall and many on the street scratching their heads around what is next.” In a matter related to “fake accounts”, it has been reported that the proceedings regarding this were further highlighted in a meeting with journalists and company executives on Thursday, and it was stated that Twitter daily eliminates about 1 million spam accounts.

Coupled with this, Musk was also provided with a reception for Twitter’s “firehouse,” which contains raw data on hundreds of millions of daily tweets, although this report was neither acknowledged by Musk nor Twitter. Ringler further stated that Twitter has recently laid off its revenue product leader and general manager of consumers, along with one-third of its talent acquisition team, which has also impacted the agreement.

You might remember that Musk agreed to pay $54.20 per share of Twitter when he intended to make this deal. In order to achieve this, he also sold Tesla shares worth $8.5 billion and also coordinated with investors, including Silicon Valley heavy hitters, who contributed around $7 billion to further intensify the clarity of the deal. Now, Twitter also has a good chance to sue Musk for his alleged backing out of the agreement for a $1 billion “breakup fee,” which the company has already authorized. Let’s see how the events will unfold along with the legal proceedings and how Elon Musk will take the course.