The collapse of global oil prices has prompted commodity traders to start hiring super-tankers because they can make a profit from storing crude oil at sea.

The oil giant Shell and energy traders Vitol and Trafigura have recently booked tankers for up to 12 months. The concept behind storing oil at sea was done back in 2009. This move is based on a situation known in the markets as a ‘contango’ – when spot or current prices fall below the cost of buying oil for delivery at a future date. Traders can currently buy a barrel of Brent oil for less than $51, while barrel for delivery in August is going for more than $57, a ‘contango’ of more than $6. Analysts say that the contango needs to be about $6.50 a barrel to cover associated costs such as tanker hire, finance and insurance and give traders a profit on offshore storage.

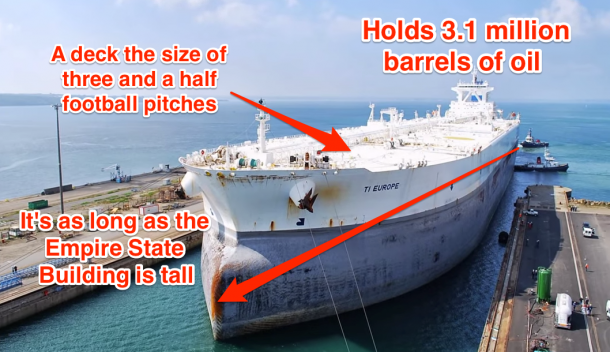

Vitol, the world’s largest independent oil trader has booked the TI Oceania Ultra Crude Carrier, one of the biggest ocean vessels in the world. It is stationed off Singapore and is likely to remain there for the most of 2015. China’s Unipec booked Oceania’s sister ship, TI Europe. These companies are waiting for prices to rebound and at that time they will begin to sell.

However, oil prices will stay low as long as there is space to store it. Once storage is full, producers will be forced to sell it because there will not be anywhere to put the surplus. Stock company Goldman Sachs, feel the turnaround won’t happen as quickly since more firms would rather store than sell oil.