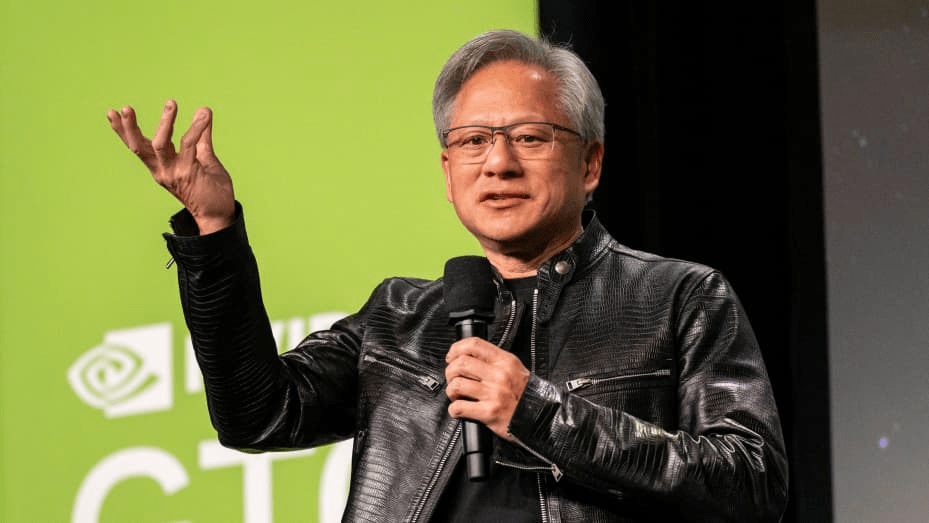

The CEO of chip manufacturer Nvidia, Jensen Huang, has had a unique experience building money. His net worth skyrocketed from a modest $3 billion to an astounding $90 billion in just five years. The unquenchable demand for Nvidia’s artificial intelligence (AI) processors is driving the company’s extraordinary stock price, which is directly linked to this incredible rise.

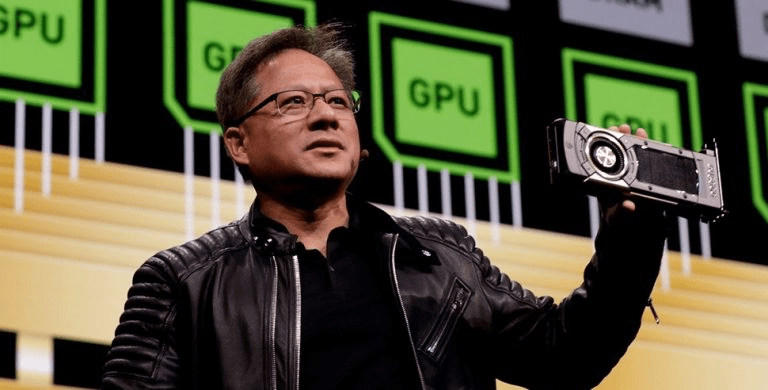

This upsurge was sparked in late 2022. ChatGPT was introduced by OpenAI, a research lab renowned for its innovative work in AI. This technique demonstrated the enormous potential of generative AI, an area in which computers are able to create totally new material and solutions by learning from enormous volumes of data. Notably, Nvidia’s powerful technology was highlighted by OpenAI, which developed ChatGPT largely relying on Nvidia’s GPUs.

The occurrence resulted in a feeding frenzy among tech companies. Major industry actors — such as Microsoft, Google, and Meta — rushed to strengthen their AI research and development departments. Creating sophisticated artificial intelligence models demands vast computational capabilities; and Nvidia’s AI-centric GPUs were considered the best available. These companies needed the latest chips from Nvidia worth billions of dollars to power their aspirations in the realm of AI. All these are derived from that event: it was an impetus for others to show interest or desire especially with all possible speed or energy.

Huang, a visionary leader — and Nvidia’s self-proclaimed “chief salesperson” — seized this chance with finesse. He kept on advocating for AI’s potential consistently and highlighted that Nvidia’s GPUs played a critical role in its advancement. For more than ten years, Nvidia had been quietly setting up the foundation— assembling a sturdy collection of AI software and tools. Their foresight positioned them as the leading candidate to be selected as the supplier among major tech companies globally; for what they have done over all those years is nothing short of laying the red carpet for these opportunities.

But Nvidia’s history wasn’t all about AI. When the company was founded in 1993, its primary goal was to produce GPUs for the rapidly expanding 3D gaming industry. For many years, this area was their main source of income. However, Huang, who has always been a thinker, saw room for expansion beyond the game industry. Nvidia deliberately ventured into other markets, including cryptocurrency mining chips, cloud gaming subscriptions, and the metaverse, a virtual environment with a lot of interaction possibilities. These were good initiatives that built a strong base; however, it was the Artificial Intelligence explosion which led Nvidia to truly unparalleled peaks. At present, they have captured an overwhelming 80% share of the AI chip market— securing their control over this indispensable sphere. The positive outcome of this triumph is reflected in the extraordinary growth of their stocks: just in 2024, Nvidia’s shares have doubled after tripling in 2023. Over the last five years, there has been a tremendous twenty-eight fold increase for their stock price.

Huang has profited greatly from Nvidia’s success due to his large ownership stake (more than 3.5%) in the company. The recent spike in stock value resulted in him gaining a whopping $7.7 billion in just one day— an astronomical increase that placed him among the top 20 richest people globally. This is truly a Silicon Valley fairy tale, witnessing such an overnight success of wealth and fortune for a tech giant like Nvidia and its visionary leader.

The tale of Jensen Huang and Nvidia serves as evidence of both the significance of strategic planning and the revolutionary potential of AI. In addition to changing the chipmaking scene, Nvidia’s CEO became extremely wealthy by embracing innovation and foreseeing market trends. It will be interesting to watch how Nvidia and Huang handle this dynamic environment as the AI revolution develops.