China’s new policy mandating automakers to earn about 40% of sales from electric vehicles by 2030 has seen an exponential rise in the manufacturing of EVs in China. As more and more automakers switch towards manufacturing electric vehicles, new startups including Nio, Li Auto and Xpeng are bringing fierce competition in the market and giving a tough time to the already established names.

BYD which is backed by Warren Buffett’s Berkshire Hathaway, is one of China’s largest electric vehicle makers. The company sold about 61,409 new battery electric vehicles and plug-in hybrids in August only, which was about four times the amount sold in the previous year. It was also a huge rise from the 50,492 cars sold in July. The company also saw an increase in its shares of about 5.5% in morning trade in Hong Kong. According to the half year results released last month, BYD said “profitability is affected to some extent by factors including rising prices of raw materials such as bulk commodities.”

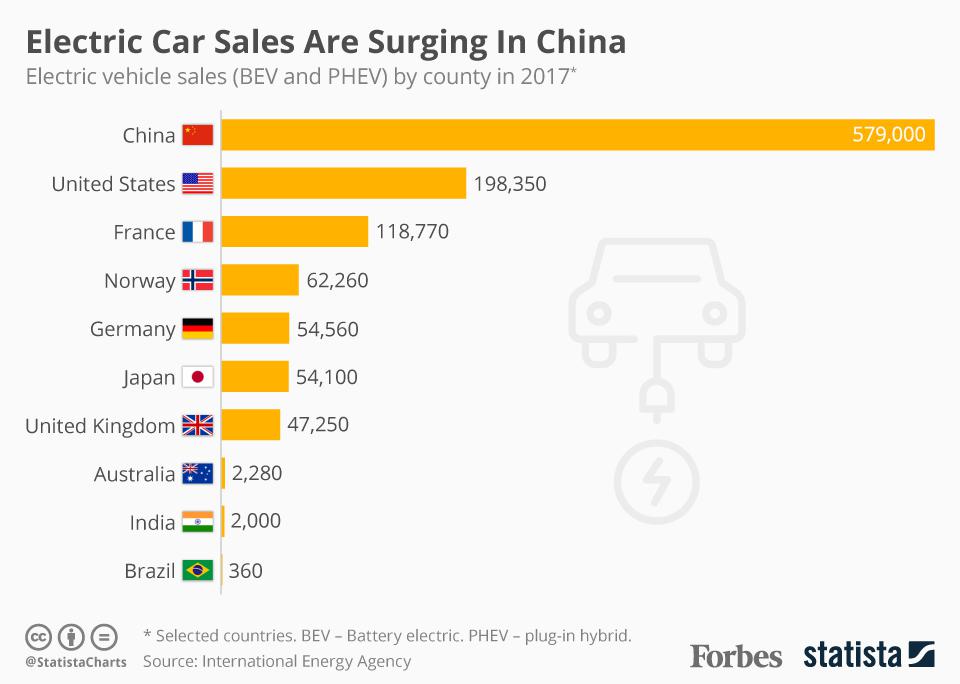

China has been taking the lead in switching from conventional cars to electric vehicles by as early as 2023 and has aimed towards selling 1.7 million new energy vehicles in the first eight months of 2021. Nio, Li Auto and XPeng are also emerging startups manufacturing electric vehicles but they have a long way to go before they can catch up to BYD, as all of them delivered under 10,000 cars in August. But due to the worldwide pandemic, the auto industry has been seeing a shortage of semiconductors that go into these EVs and has been struggling to manufacture the desired number of cars.