Most of us are guilty of spending more than we should and as a result, we tend to miss out on things that can make our lives better and create better living standards for us. Now don’t get me wrong. Saving money isn’t important for the sake of love of wealth or going on shopping sprees later on. It is about having the ability to enjoy life as much as you can within your resources and save good money for the next generation. For many people, saving money is difficult not because the math on this is complicated. It is because they haven’t yet trained their hands to spend appropriately according to the situation.

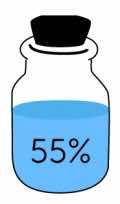

Also, with household money, it doesn’t matter how many apps you use. It all comes down to how you have defined your spending and how you intend to implement them. This basic jar method is the best way to distribute your expenses throughout the month and has helped people achieve a lot of savings and education the old-school way. Here it is:

First Jar (Basic living expenditure)

Second Jar (Education)

Third Jar (Entertainment)

Fourth Jar (Savings)

Fifth Jar (Small term savings that you use for paying gym membership, car repairs, etc. )

Sixth Jar (Charity and Gifts)

So, this balanced expenditure plan can be actually physically implemented. You can have your money placed in these jars and then survive on it. Of course we use credit cards nowadays but following this plan isn’t that difficult with electronic money as well. In fact, it is much easier. So, what do you think of it?