It is expected that this month if all goes to plan, the energy-hungry digital sector will experience its biggest shake-up in years.

Ethereum, the world’s second-largest cryptocurrency, is tomorrow expected to start a technology changeover which, once complete, should cause its carbon emissions to plummet by 99 percent.

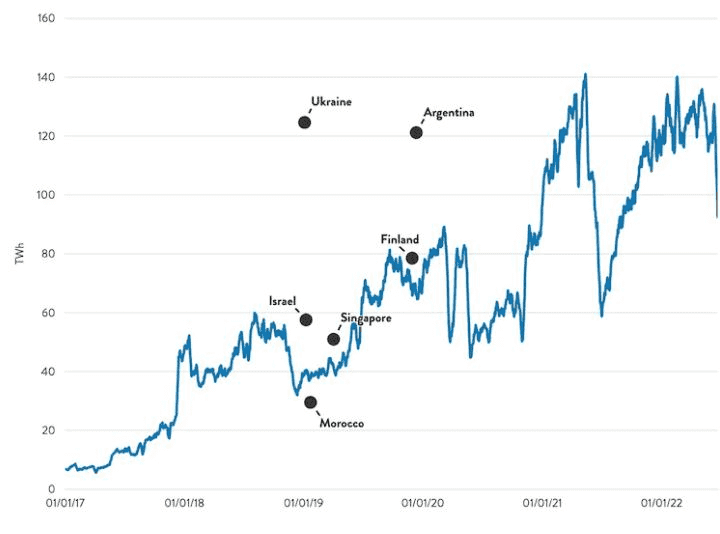

The heat produced by computers to buy ad sell crypto is damaging the environment. For example, Bitcoin uses more energy each year than medium-sized nations like Argentina.

If the Ethereum switch succeeds, Bitcoin and other cryptocurrencies will be under pressure to deal with this problem.

Unlike conventional currencies, cryptocurrencies are not managed from a single location like a central bank. Instead, they’re managed by a ‘ blockchain’: a decentralized global network of high-powered computers. These computers are known as ‘miners’.

The Reserve Bank of Australia provides this simple explanation of how it all works (edited for brevity):

Let’s imagine Alice wants to transfer one unit of cryptocurrency to Bob. Alice sends the electronic message with her instructions to the network, where all users can see the message.

The transaction sits with a group of other recent transactions waiting to be compiled into a block (or group) of the most recent transactions.

The information from the block is turned into a cryptographic code and miners compete to solve the code to add the new block of transactions to the blockchain.

Once a miner successfully solves the code, other users of the network check the solution and reach an agreement that it’s valid. The new block of transactions is added to the end of the blockchain, and Alice’s transaction is confirmed.

This process is called ‘proof-of-work mining’. The central design feature is the use of calculations that demand a lot of computer time and electricity.

The proof-of-work approach intentionally wastes energy.

This month, Ethereum promises to switch its computing technology to something far less polluting.

They will go for a new work model called ‘proof of stake’.

Under this model, crypto transactions are validated by users, who stake substantial quantities of blockchain tokens (in this case, Ethereum coins) as collateral. If the users act dishonestly, they lose their stake.

This would also mean that the supercomputers used now will not be required anymore. Getting rid of the computer ‘miners’ will lead to an estimated 99 percent drop in Ethereum’s electricity use.

Some smaller cryptocurrencies – such as the Ada coin traded on the Cardano platform – use ‘proof of stake’, but it’s been confined to the margins to date.

The change is already in motion. Tesla founder Elon Musk last year announced his company would no longer accept Bitcoin payment for its electric cars, due to the currency’s carbon footprint.