When looking at gold and its close relationship with political and economic factors, there is no denying that businesses, as well as individuals, look to invest every year from all over the world. But why is it a worthwhile investment for you? In this article, we are going to look into why buying gold may be a profitable investment for you in 2019 and years to come.

What To Look For When Buying Gold?

When looking to invest money in gold, there are a number of key factors to consider, each of these contributing factors determine the overall price of the gold as well as influence the amount that you will be able to sell it for in the future. We have featured a list below to help you identify what to look out for.

- Make Sure You Are Buying From A Reputable Dealer

- Look At Trust pilot Ratings

- Cost Per Gram

- Level of Purity

Each of these are beneficial to your overall investment as it can sell got a higher profit when it comes to cashing in.

Political Uncertainty

During the last 3 years, the UK and other areas of the World such as The USA and China have experienced a vast amount of political uncertainty that has shown no sign of slowing down. With the ongoing Brexit agreement between the UK and the European Union as well as the ongoing trade war between the US and China there have been a number of people looking to buy gold, but why is that? The simple reason is that Gold holds its value during political uncertainty.

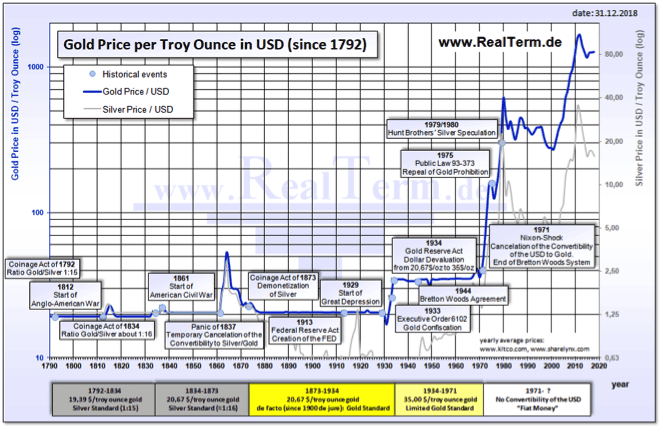

As you can see from the chart pictured above, there have been a number of fluctuations in the price of gold over the years, however, there is set to be a vast increase in the price of gold heading into the latter part of 2019 as well as 2020. Though this is only a prediction, this is still very telling and could be as a result of further political uncertainty.

Economic Uncertainty

Though this is not always the case, political uncertainty oftentimes leads to economic uncertainty as a result. A prime example of this is the drop in the pound following the 2016 referendum result that saw a thin majority vote to leave the European Union, this result led to a drop of 10% seeing the pound drop to its lowest price since 1985. During times of economic uncertainty, you often see businesses as well as individuals investing in gold as it holds value in times when inflation is rising. It also helps you to prepare for a potential stock market correction or crash as this will help you to hedge your investment should the price of the pound, euro or dollar fall to an all-time low.

It Holds Value

As inflation continues to rise, gold is an investment that holds its value. This not only helps you to have financial security, but the price of gold increases as inflation begins to rise. During this time, you then have the choice to hold onto the investment that you have made or cash in a take the money for yourself. In this case, it is important to be aware of the changes to the market and monitor when to cash in your investment. Though there is a slow decline in the amount of mining plans there are in the pipeline, the amount of gold in circulation is significant enough to keep up with high demand.

Liquidity

Due to the liquidity of gold, it is easy to cash it in regardless of where you are in the world as it is a recognised currency. With approximately 2500 tons of gold mines through the year, it is all about the quality of the gold that you have as well as the amount. When looking to cashing any gold that you have, it is important to get it valued, whether this is by a jeweller or the person you are looking to sell to. Do not rush into this process as this can lead to you missing out on money that your gold is worth. Picking the right time to cash in is vital to ensuring that you get the best possible payout.

With all the recent political uncertainty as well as fluctuations in the economy of a number of the world’s leading superpowers, there is an increase in the number of people investing in gold as the year goes on. Will you be investing?