The timeless De Beers slogan, “A diamond is forever,” might not be relevant to the increasing number of buyers who choose lab-grown diamonds, gold, and other colored gemstones for real diamonds.

Once considered the biggest name in the diamond business, De Beers is undergoing significant restructuring. Anglo American, De Beers’ biggest shareholder, intends to sell its shares after BHP’s buyout offer was turned down. As he described the sale as “the hardest part” of the company’s restructuring efforts, CEO Duncan Wanblad acknowledged the difficulty.

“Diamonds don’t fit in anymore despite the strong legacy of De Beers under Anglo,” said independent diamond industry analyst Paul Zimnisky. Anglo-American aims to align its strategy with shareholder interests, focusing on commodities like copper that support green infrastructure.

Market research firm Daxue Consulting claims that declining marriage rates and a rising inclination towards gold and lab-grown stones have decreased the demand for diamonds in China. Furthermore, post-pandemic spending has turned towards travel-related activities rather than buying diamonds. According to Zimnisky’s rough diamond index, this tendency has caused diamond prices to fall 5.7% this year, more than 30% from their peak in 2022.

De Beers is losing ground to competitors. Due to economic difficulties, the company had to lower prices early this year by 10%. “Last year was a much tougher period for the [diamond] industry as economic challenges, a post-Covid lull in engagements, and a growth in the supply of lab-grown diamonds all affected demand conditions,” noted Anglo American’s head of communications, Marcelo Esquivel.

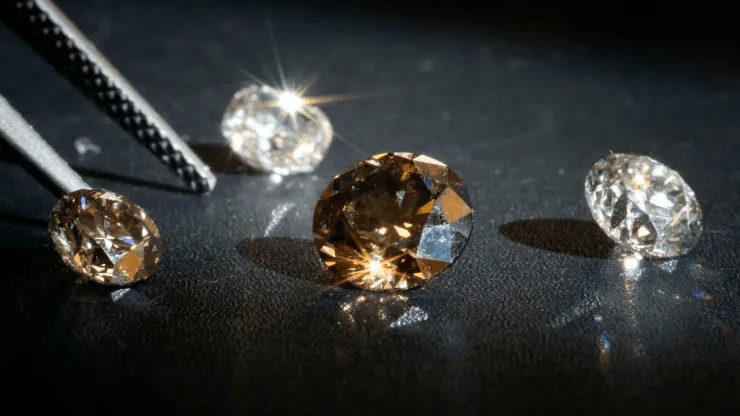

The rise of lab-grown diamonds is a major factor driving down natural diamond prices. Ankur Daga, founder and CEO of Angara, pointed out that lab-grown diamonds, which can be up to 85% cheaper, have rapidly gained market share. In the U.S., half of the engagement ring stones sold this year are expected to be lab-grown, up from just 2% in 2018. Lab-grown diamond sales now represent 18.4% of the global diamond jewelry market, a significant increase from 2% in 2017.

Daga also noted that diamonds’ investment appeal has diminished. “The diamond industry is in trouble,” he said, predicting a further 15% %- 20% drop in natural diamond prices over the next year. However, some industry experts remain hopeful. Anish Aggarwal, co-founder of Gemdax, believes that the diamond industry’s challenges can be addressed through strategic marketing.

Aggarwal emphasized the need for the diamond industry to reignite consumer desire, similar to luxury watches and bags. “The industry has not done large-scale category marketing for almost 20 years. And we’re seeing the aftermath of that,” he said, advocating for a cohesive marketing approach. Zimnisky agreed, suggesting that effective industry marketing could revitalize the diamond market.

Signet Jewelers, the world’s largest jewelry retailer, recently announced a marketing collaboration with De Beers to boost demand for natural diamonds. Signet anticipates a 25% increase in engagements over the next three years. Esquivel added that higher engagement rates and rising disposable incomes could help alleviate market challenges.

“It’s the largest diamond miner in the world and the largest diamond retailer in the world working together, so it’s significant and could move the needle for the larger industry,” said Zimnisky, highlighting the potential impact of this partnership on the diamond market.