Tesla’s sales downturn in Europe deepened in August, highlighting the pressure the U.S. electric vehicle pioneer faces from fierce Chinese competition and growing consumer backlash against CEO Elon Musk. Despite isolated gains in a few markets, data shows Tesla registrations sliding sharply across much of the continent while rival BYD continues its rapid ascent.

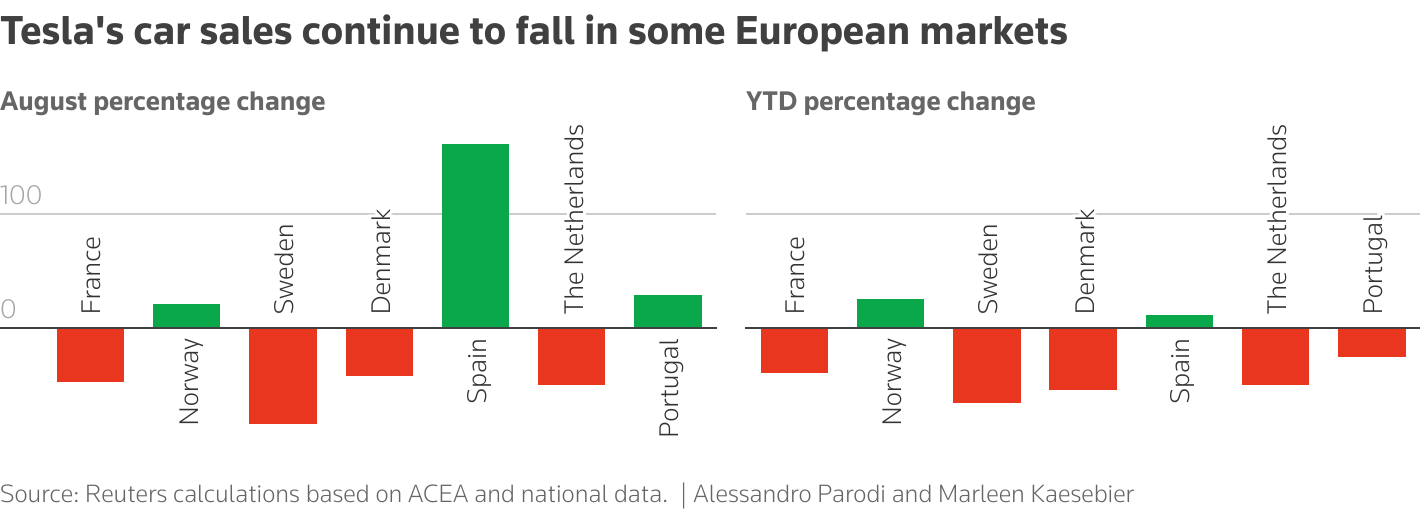

In France, Tesla registrations fell 47.3% year-on-year even as the overall car market grew by 2.2%. Sweden saw an even more dramatic collapse, with Tesla sales plunging over 84%, compared with flat EV sales overall and a 6% rise in the broader auto sector. Denmark reported a 42% decline, the Netherlands a 50% drop, and Italy a smaller 4.4% fall.

There were some bright spots. In Norway, one of Tesla’s most established markets where nearly all car sales are electric, registrations climbed 21.3%. Yet even there, BYD outpaced Tesla with an eye-catching 218% surge. Spain and Portugal also offered rare relief: Tesla sales in Spain soared 161%, supported by generous EV subsidies, while Portugal saw a 28.7% increase after seven months of declines. Still, BYD once again outperformed, selling more cars than Tesla in Spain and notching a 675% year-to-date increase, compared with Tesla’s modest 11.6% rise.

Industry analysts argue Tesla’s slump is not simply a matter of cyclical demand. Matthias Schmidt of Schmidt Automotive noted that Musk sounded “delusional” when he insisted in July that “there are no issues with Tesla volumes on the European market,” despite its western European market share sliding from 2.5% in 2024 to just 1.7% in the first half of 2025. Tesla’s representatives had blamed the slowdown on the production shift to a revamped Model Y, which had been Europe’s best-selling car in 2023. But the relaunch has so far disappointed, with Model Y sales falling 46.5% in Denmark and 87% in Sweden last month.

Compounding the issue is the backlash against Musk’s political activities. His financial backing of Donald Trump’s presidential campaign and vocal support for European far-right movements have dented Tesla’s brand image. According to Ginny Buckley, CEO of Electrifying.com, Musk’s polarizing influence is now a direct liability: more than half of surveyed potential buyers said Musk himself discouraged them from purchasing a Tesla. “Tesla’s dominance is no longer a given,” she said.

Adding further pressure, Tesla’s aggressive price cuts in 2023 have flooded the secondhand market with cheaper vehicles. The resale value of its models has plunged, with used Model Y prices in Britain down 41% in two years. Data from Marketcheck shows sales of used Teslas in the UK hit a record in July, up 270%, underscoring how the brand’s residual value problem is undercutting new sales.