The deployment of small modular nuclear reactors (SMRs) to address increasing energy demands globally has been evaluated in a recent report, revealing significant challenges and drawbacks associated with this form of energy production. SMRs, defined as nuclear plants with a capacity up to 300 megawatts, were once touted as a solution to the complexities, security risks, and costs of large-scale reactors. However, the report, titled “Small Modular Reactors: Still Too Expensive, Too Slow, and Too Risky,” challenges the viability of SMRs in meeting energy demands effectively.

“The rhetoric from small modular reactor (SMR) advocates is loud and persistent: This time will be different because the cost overruns and schedule delays that have plagued large reactor construction projects will not be repeated with the new designs,” says the report. “But the few SMRs that have been built (or have been started) paint a different picture – one that looks startlingly similar to the past. Significant construction delays are still the norm and costs have continued to climb.”

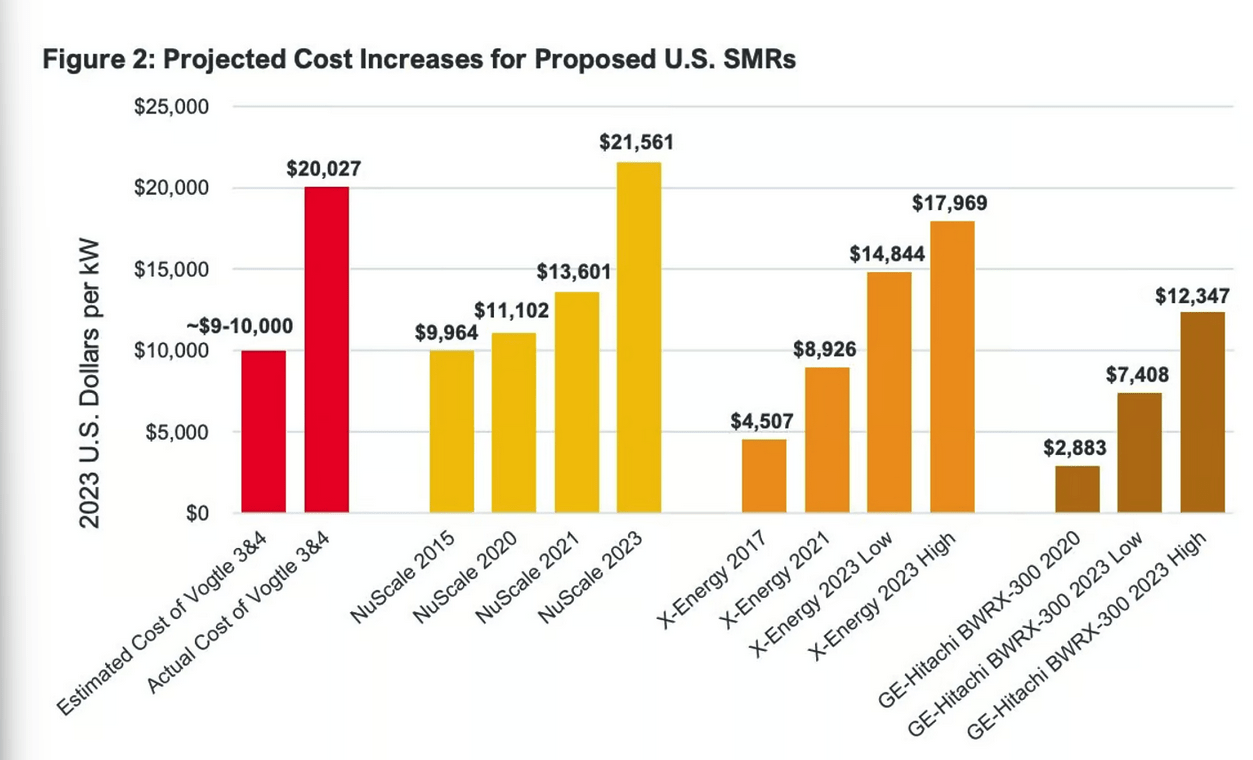

One of the primary arguments against SMRs presented in the report is their excessive cost. Data provided in the report indicates that all existing SMRs have experienced significant cost overruns, with several projects surpassing initial budget estimates. For example, the NuScale project in Idaho saw costs escalate from $9,964 to $21,561 per kilowatt during its development phase. These cost overruns not only hinder the economic feasibility of SMRs but also divert resources away from alternative, cleaner, and more rapidly deployable energy sources such as wind, solar, and battery storage.

“It is vital that this debate consider the opportunity costs associated with the SMR push,” write the authors. “The dollars invested in SMRs will not be available for use in building out a wind, solar and battery storage resource base. These carbon-free and lower-cost technologies are available today and can push the transition from fossil fuels forward significantly in the coming 10 years – years when SMRs will still be looking for licensing approval and construction funding.”

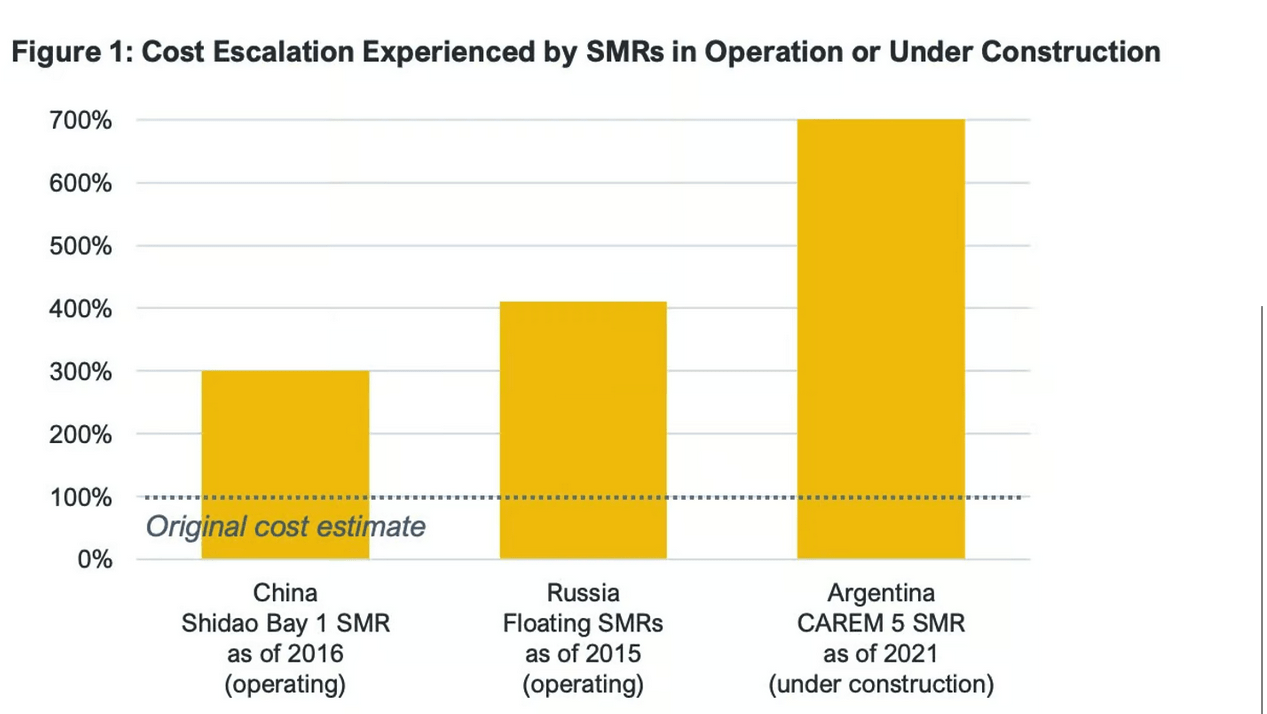

The report scrutinizes the delays encountered in the construction of small modular nuclear reactors (SMRs), revealing significant discrepancies between initial projections and actual completion times. Projects like the Shidao Bay endeavor in China, initially anticipated to take four years, extended to 12, while the Russian Ship Borne project, slated for three years, took 13.

Similarly, the ongoing CAREM initiative in Argentina, projected to conclude in four years, is now in its 13th year of development.

“Despite this real-world experience, Westinghouse, X-Energy and NuScale, among others, continue to claim they will be able to construct their SMRs in 36 to 48 months, perhaps quickly enough to have them online by 2030,” write the authors. “GE-Hitachi even claims it ultimately will be able to construct its 300MW facility in as little as 24 months.

“Admittedly, there is a not-zero chance this is possible, but it flies in the face of nuclear industry experience, both in terms of past SMR development and construction efforts and the larger universe of full-size reactors, all of which have taken significantly longer than projected to begin commercial operation.”

Furthermore, while advancements such as expedited welding techniques may streamline SMR manufacturing, the report emphasizes that deployment remains a significant hurdle. The IEEFA highlights the considerable financial risks and extensive delays associated with SMR development, making them an unattractive investment.

Safety concerns also loom large due to the relative novelty of SMR technology. Questions arise regarding the reliability of SMRs and their ability to deliver the promised power outputs. Additionally, there is limited information available on the operational costs, maintenance requirements, and decommissioning procedures of SMRs, raising uncertainties among regulators and stakeholders.

In terms of safety, the report quotes a 2023 study for the US Air Force that said: “Since SMR technology is still developing and is not deployed in the US, information is scarce concerning the various costs for [operations & maintenance], decommissioning and end-of-life dissolution, property restoration and site clean-up and waste management.”

Moreover, the report underscores the potential global repercussions of SMR failures. Utilizing standardized designs across multiple SMR projects increases the risk of widespread consequences in the event of component malfunctions or safety incidents. For instance, issues observed in steam generators at pressurized water reactors (PWRs) highlight the systemic vulnerabilities inherent in deploying identical technologies across numerous reactors.

“We’re not arguing that new SMRs will have these same issues,” they write. “We expect that the design and material decisions made for SMRs will reflect remedial measures taken at existing reactors. Our concern is broader in that a problem at one SMR might have serious repercussions at many other SMRs with the same standardized design.”

“At least 375,000 MW of new renewable energy generating capacity is likely to be added to the US grid in the next seven years,” they say. “By contrast, IEEFA believes it is highly unlikely any SMRs will be brought online in that same time frame. The comparison couldn’t be clearer. Regulators, utilities, investors and government officials should acknowledge this and embrace the available reality: Renewables are the near-term solution.”