Next month, 15 shareholders who cast votes on Elon Musk’s $56 billion compensation plan will get exclusive tours of Tesla’s factory.

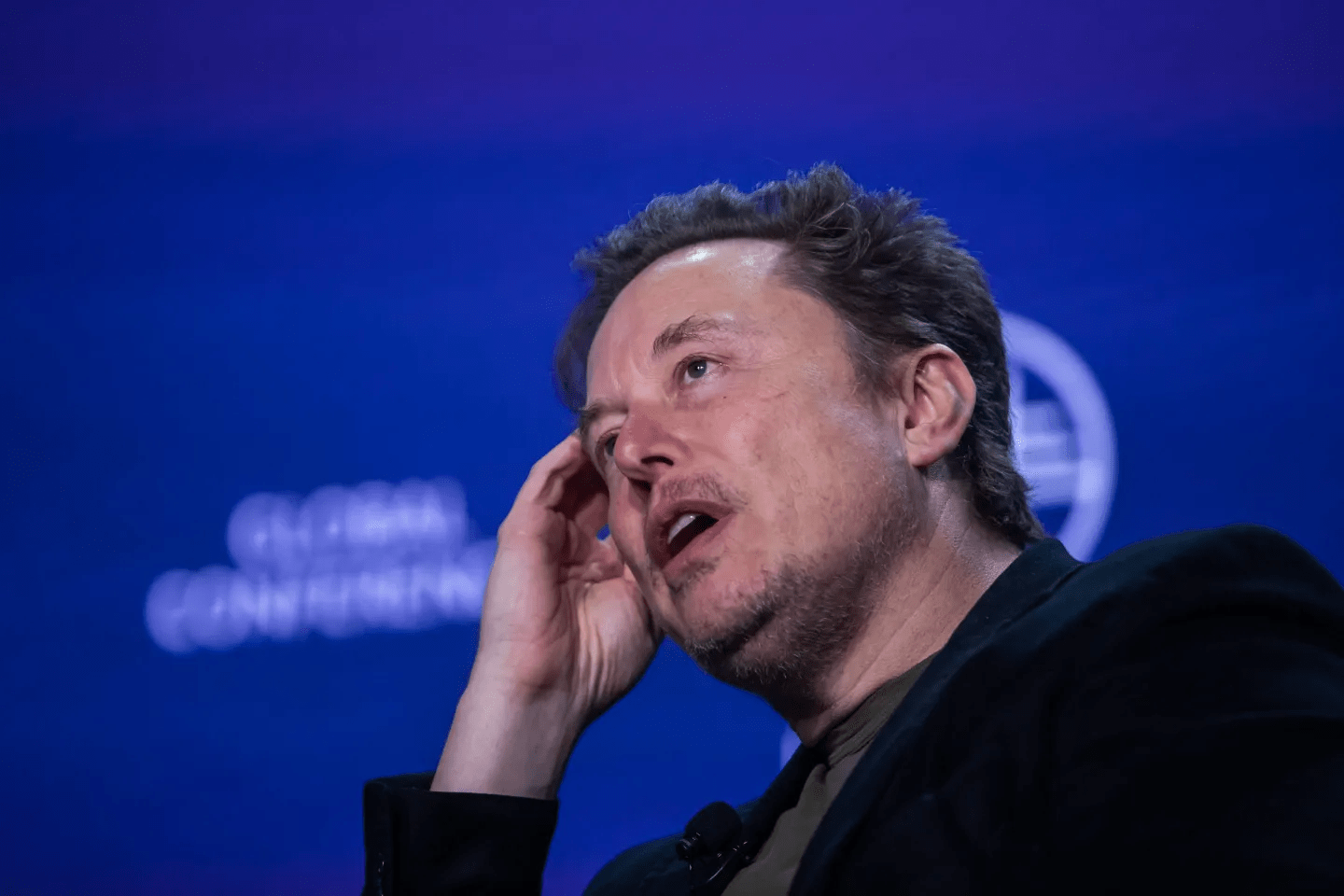

Many see the upcoming vote—which will be announced at Tesla’s annual meeting on June 13—as a vote against Musk’s leadership. The significance of this vote has increased due to investor concerns that Musk is focused on his other ventures and that his frequently provocative remarks could harm Tesla’s sales and reputation.

Tesla is putting out a remarkable, high-profile effort to win people over to Musk’s compensation. The board of the company maintains that Musk must prioritise Tesla despite his many other responsibilities, and that’s why the compensation plan is so important. The board has asked shareholders to confirm that they support the compensation package, which was first announced in 2018 but was later disallowed by a judge because it was thought to have been arranged by directors who were too close to Elon Musk.

“Don’t delay, vote today!” Tesla urged on Tuesday.

On June 12, a day before the annual shareholders’ meeting, Musk and other Tesla executives will lead a tour of the company’s production lines for Cybertrucks and Model Ys in Texas. This move is seen as “the last-ditch effort to try to charm retail investors,” said Nell Minow, vice chair of ValueEdge Advisors, a corporate governance advisory firm.

S&P Global Market Intelligence reports that 44 percent of Tesla’s common stock is held by nonprofessional shareholders, including retail investors. This is the greatest percentage of any of the ten largest S&P 500 businesses.

“I think it just speaks to his grandiosity that he thinks that somehow being in his presence is going to have the results he wants. I don’t think he’s changing anybody’s vote from doing this,” Minow added.

Glass Lewis, a proxy consulting firm, has advised Tesla shareholders to reject the compensation package due to Musk’s “slate of extraordinarily time-consuming projects.” Voting against the package was Tesla investor Kristin Hull, founder of Nia Impact Capital, who stated, “His focus is clearly not just on Tesla.”

In addition to being the richest person in the world, Musk is the founder of xAI, an AI startup that recently acquired $6 billion in funding, and the CEO of SpaceX. He has owned Twitter since 2022. Musk currently owns roughly 13% of Tesla; if he were to take advantage of his stock options, that percentage would rise to 22%. Should Elon fail to obtain 25 percent voting power—which would necessitate some of the stock options included in the compensation deal—he has threatened to pursue artificial intelligence initiatives outside of Tesla.

Elon Musk has highlighted that Tesla’s self-driving technology’s AI capabilities play a major role in the company’s valuation, saying that the company would be “worth basically zero” without complete self-driving capabilities.

Parallel to this, Tesla promised Delaware Chancellor Kathaleen McCormick, who dismissed Musk’s record-breaking Tesla compensation package, that her decision would not be overturned by the upcoming shareholder vote. It’s still unclear if she knew about Musk’s offer to give her a factory tour.

Orders were sought by the shareholder legal team that filed over Musk’s $56 billion compensation package to keep their case from being overturned in another court, like Texas. Reassuring McCormick, Tesla dismissed these worries as “rank speculation,” claiming Delaware would continue to have jurisdiction over the compensation dispute.

“If I have interpreted the defendants’ position incorrectly, then defense counsel–as officers of the court–are duty-bound to correct it. In the meantime, the defendants’ statements give me great comfort,” McCormick stated in her seven-page letter.

On June 13, shareholders of Tesla will cast their votes over the reaffirmation of Musk’s compensation package and the company’s reincorporation in Texas, the location of its headquarters, from Delaware, the legal home of numerous large publicly traded firms.

Before Musk and Tesla can appeal, McCormick must decide on a $6 billion legal fee request from the shareholders’ legal team, with a hearing scheduled for July 8.