On Thursday, the net worth of Tesla CEO Elon Musk increased by $26 billion after Tesla shares recorded their most significant rally since 2013. Following a strong earnings report and optimistic guidance, Tesla’s shares rose 22%, which is the second-largest gain since the company’s IPO in 2010. This rise has consequently placed Musk’s fortune at around $269 billion, thus keeping him firmly in place as the world’s richest person and putting him $50 billion ahead of his friend, Oracle’s Larry Ellison.

That lift was induced by the 72 cents in Earnings Per Share recorded by Tesla against the prediction of 58 cents by analysts. The company attributed this to $739 million environmental regulatory credits and also $326 million from Full Self-Driving (FSD) revenue. Long-term promises are also made to the vision of autonomous vehicles by Musk through announcing in which states, Texas and California, Tesla’s ride-hailing service will soon be publicly rolled out.

However, Tesla’s autonomy claims face scrutiny. While Alphabet’s Waymo has operated a commercial driverless service since June, Tesla has struggled to meet its own deadlines for full autonomy, and human supervision is still required for Tesla vehicles. Delays continue to impact other Tesla projects as well; the Semi truck is only in pilot production, and the highly anticipated Roadster redesign remains incomplete.

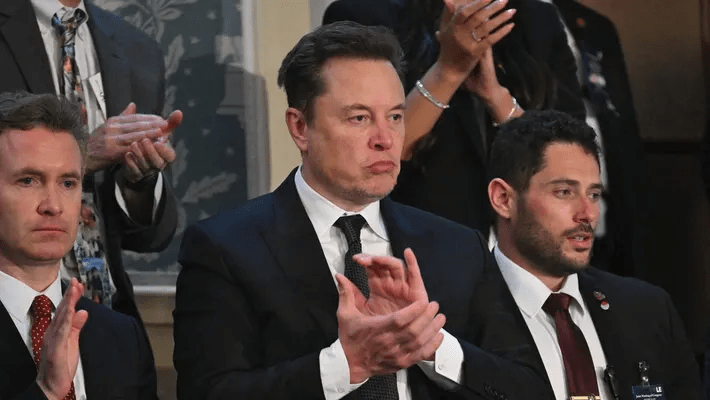

Outside of Tesla, Musk’s political activities have stirred controversy, especially his outspoken support for former President Donald Trump. Musk’s endorsement has included significant financial contributions and campaigning efforts in swing states. He also announced a plan to offer $1 million daily in voter incentives, which the Department of Justice is investigating for potential federal election law violations.

This political activism has sparked concerns among Tesla investors, with some questioning whether Musk’s focus on political issues might undermine shareholder value and Tesla’s growth.