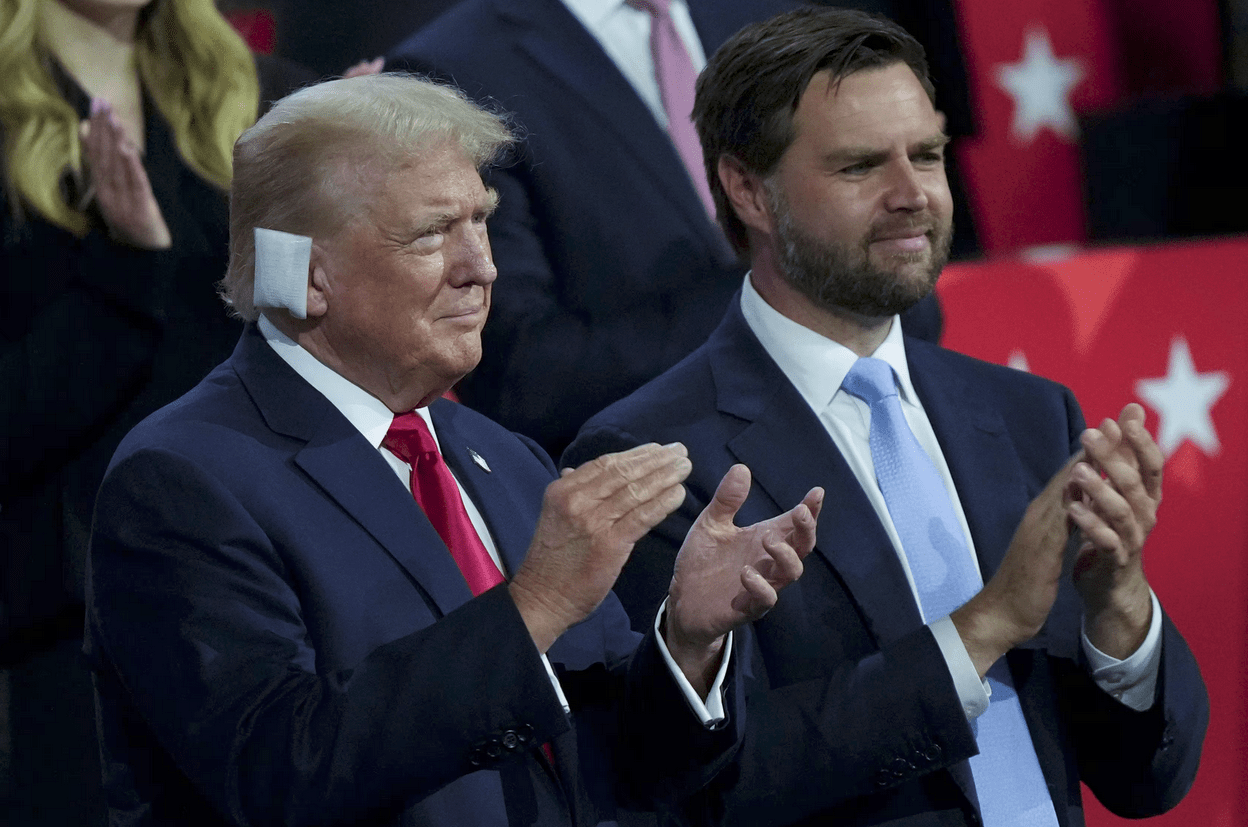

A Trump-Vance presidency could significantly alter the trajectory of electric vehicle (EV) adoption in the U.S. Both Donald Trump and his vice-presidential pick, Ohio Senator JD Vance, have expressed intentions to repeal the $7,500 federal EV tax credit, which is part of the Biden administration’s Inflation Reduction Act designed to make EVs more affordable for consumers.

Trump has indicated a desire to reverse Biden’s EV policies, while Vance has already taken steps in this direction. In September 2023, Vance introduced the Drive America Act, which proposes to replace the federal EV tax credit with a subsidy for purchasing American-made gas- and diesel-powered cars. However, this act has not yet progressed in Congress.

Tesla founder Elon Musk has surprisingly shown support for repealing EV incentives, despite Tesla’s prominent use of these credits to boost sales. As of now, eight Tesla vehicle trims, including all trims of the popular Model Y, qualify for the federal tax credit.

Musk argues that removing subsidies would benefit Tesla, which has struggled with maintaining tax credit eligibility due to its vehicles’ components being partially sourced from China. By removing the credit, Tesla could potentially attract buyers without facing scrutiny over its supply chain.

“Take away the subsidies,” Musk says. “It will only help Tesla.”

Musk’s stance may also stem from a competitive angle. If Tesla is unable to qualify for the credit while other brands like Ford, Rivian, and GM do, it puts Tesla at a disadvantage. Eliminating the credit would level the playing field, allowing Tesla to source materials from China without deterring buyers or generating negative press.

JD Vance’s motivation for the Drive America Act is to counteract job creation abroad, particularly in China, due to EV manufacturing. However, the Biden administration claims it has created 250,000 automotive jobs, and the United Auto Workers union has endorsed Biden for re-election.

Despite these claims, a Trump-Vance administration could see a rollback of EV incentives, potentially slowing down the growth of the EV market in the U.S. Notably, in the first two months of 2024, approximately 25,000 Americans utilized the EV tax credit to purchase an EV, highlighting its impact on consumer behavior.