Predicting industry peaks is challenging, often leading to either post-factum clarity or prolonged ridicule for analysts. However, this is not just another analyst’s projection; this comes from Sinopec, China’s largest fuel distributor, a company deeply rooted in the fuel business. Their declaration that gasoline’s downhill journey is beginning carries substantial weight.

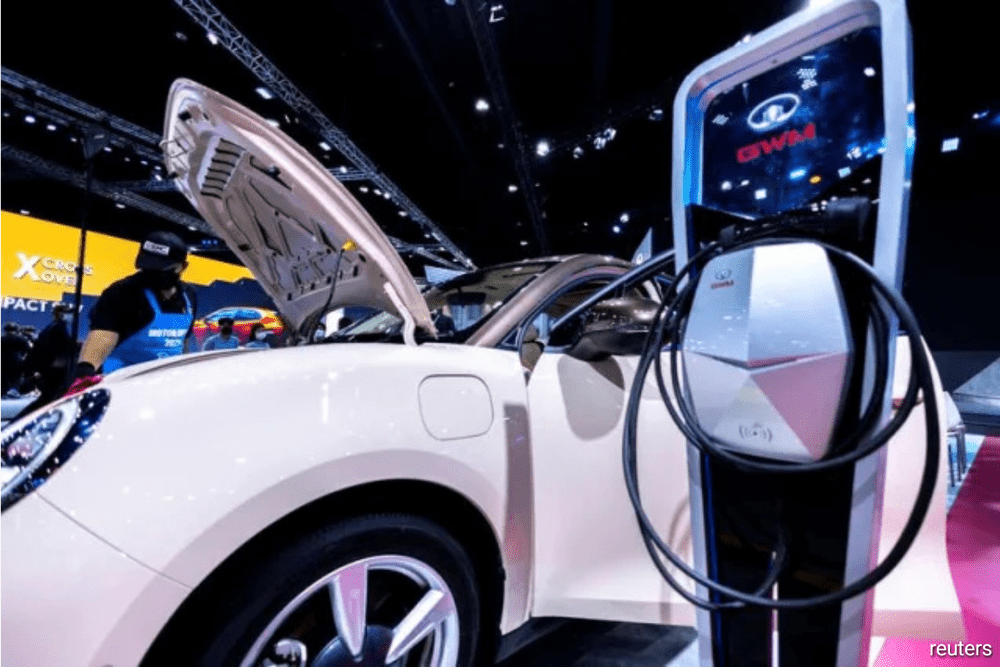

Over the past two decades, China has stood as a central propeller of global growth in refined oil products like gasoline and diesel. Nevertheless, the landscape is rapidly transforming due to the skyrocketing adoption of electric vehicles. August’s statistics are poised to show that plug-in cars will account for 38% of new passenger vehicle sales, a remarkable ascent from the mere 6% in 2020. This shift is notably affecting fuel demand.

The decline in fuel demand for two and three-wheeled vehicles is already evident and structural. Estimates from BNEF indicate that a significant 70% of total kilometers traveled by these vehicles have transitioned to electric. Following suit, demand for car fuel is set to follow this pattern, mainly as over 5% of the passenger vehicle fleet now constitutes battery-electric or plug-in hybrid models. Simultaneously, internal combustion engine vehicles are becoming more efficient due to escalating fuel economy targets.

While diesel demand for heavier vehicles still experiences growth, change is afoot even here. Electric, fuel cell, and battery-swapping options have secured a 12% share of light commercial vehicle sales and 4% to 5% in medium and heavy retail vehicle sales. Projections anticipate that the heavy-duty segment will exceed 10% by 2025.

All these factors merge to form BNEF’s forecast that total oil demand for road transport in China will peak shortly, possibly late next year. This doesn’t imply an abrupt plunge, particularly given the gradual turnover of the trucking segment. Nonetheless, this shift signifies a monumental change in global oil demand dynamics, necessitating substantial adjustments for refiners in terms of product composition.

Sinopec’s announcement unveils another intriguing facet—China’s ride-hailing industry’s influence on urban gasoline demand. In contrast to privately owned cars, ride-hailing vehicles in China are increasingly electric, comprising nearly 40% of the fleet. These electric ride-hailing vehicles proved more productive, accounting for half the distance traveled on the prominent ride-hailing platform Didi in December.

Beyond economics, supportive policies play a pivotal role in the ascendance of EVs in the ride-hailing sector. Many large Chinese cities facilitate the acquisition of EVs over conventional vehicles for ride-hailing drivers. This policy-driven momentum underscores the broader energy impact, emphasizing that assessing only the vehicle fleet can overlook the entire narrative.

Drawing a parallel with Norway, where EVs have surpassed internal combustion vehicles in average distance covered, the implications of China’s shift to electric transportation extend beyond just the vehicle count. While Norway’s impact on global oil demand is minor, China’s influence is monumental. The speed at which oil relinquishes its share in the transportation mix hinges on how rapidly countries like China transition not solely their vehicle count but also their traveled kilometers to electric modes.

Transitioning to a new technology often starts sluggishly. Recall the microwave oven, which took two decades to gain traction in US households before becoming ubiquitous in the 1980s. A similar swift adoption curve is unfolding now with electric vehicles. A year ago, Bloomberg Green identified 19 countries where 5% of new car sales were electric. Since then, five more nations have crossed this threshold, marking the rapid progression of electric vehicle adoption.