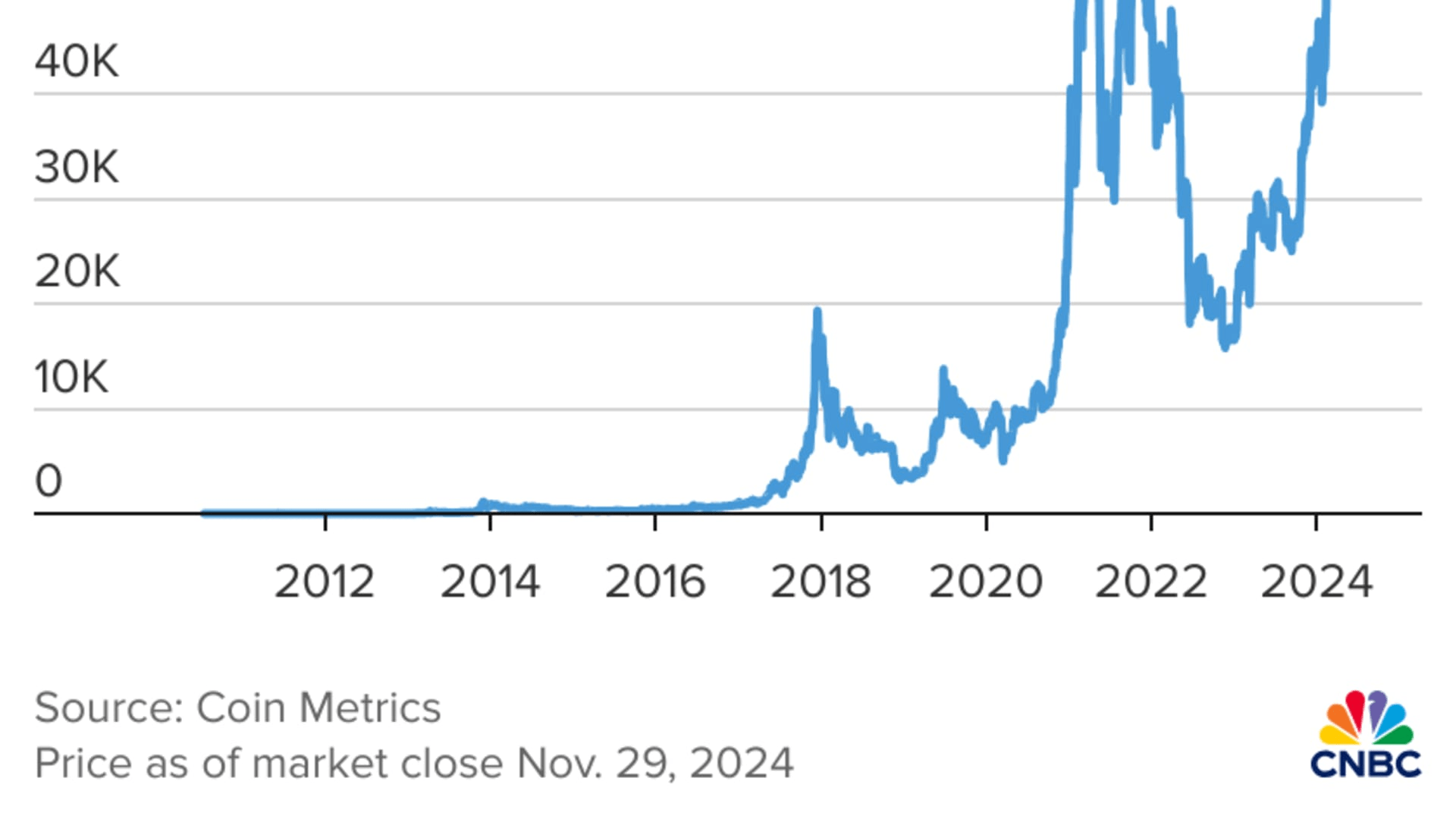

Having shattered the $100,000 barrier, Bitcoin leaped to never-before-seen heights late Wednesday evening, in what can easily be marked as a milestone moment for the cryptocurrency. By percentage, that flagship digital asset gained over 4% to trade at $103,544.00 after briefly poking its nose toward a record high of $103,844.05, according to Coin Metrics. In fact, Bitcoin has already logged a more than 140% gain since the beginning of the year on the back of increasing institutional adoption and major political developments.

This rally was concurrent with news breaking of President-elect Donald Trump nominating Paul Atkins as the future SEC chair, which can be viewed as a foreshadowing of change in regulation and its attitude toward digital currency. Atkins’ appointment was generally perceived as an alleviation for this business community since it substituted Gary Gensler, whose approach on things of enforcement had caused constant frustrations amongst crypto proponents for a lengthy period.

This accomplishment is a testament to the trust and perseverance of long-term bitcoin investors despite the asset’s turbulent past. Traditional financial institutions were skeptical of and opposed to Bitcoin, which was developed as a decentralized, peer-to-peer payment system during the 2008 financial crisis. However, its strong blockchain technology and anti-establishment philosophy have drawn more and more attention from institutions.

The introduction of spot bitcoin ETFs by financial behemoths like BlackRock, Fidelity, and Invesco in 2024 dubbed by many as bitcoin’s “IPO moment” marked a turning point for the cryptocurrency. Prices have increased dramatically due to institutional demand for these products. Charles Schwab has also indicated that it is prepared to start trading cryptocurrencies while awaiting regulatory clarification.

Federal Reserve Chair Jerome Powell added fuel to the conversation, likening bitcoin to “digital gold” during the DealBook conference. While acknowledging it is not yet used as currency, he emphasized its role as an alternative store of value.

Galaxy Digital CEO Mike Novogratz declared this surge as the beginning of a paradigm shift, with pro-crypto policies under Trump likely to accelerate mainstream adoption. Novogratz cautioned against assuming a linear trajectory but remained optimistic about Bitcoin’s long-term potential.

The stage is set for Bitcoin and the broader digital asset ecosystem to redefine the global financial landscape.