A lawsuit is headed toward Apple Pay, claiming that Apple has an illegal monopoly over contactless payments on the iPhone, letting it force card issuers into paying fees (via Bloomberg). The suit is being filed by Iowa-based Affinity Credit Union, which issues debit and credit cards that are compatible with Apple Pay.

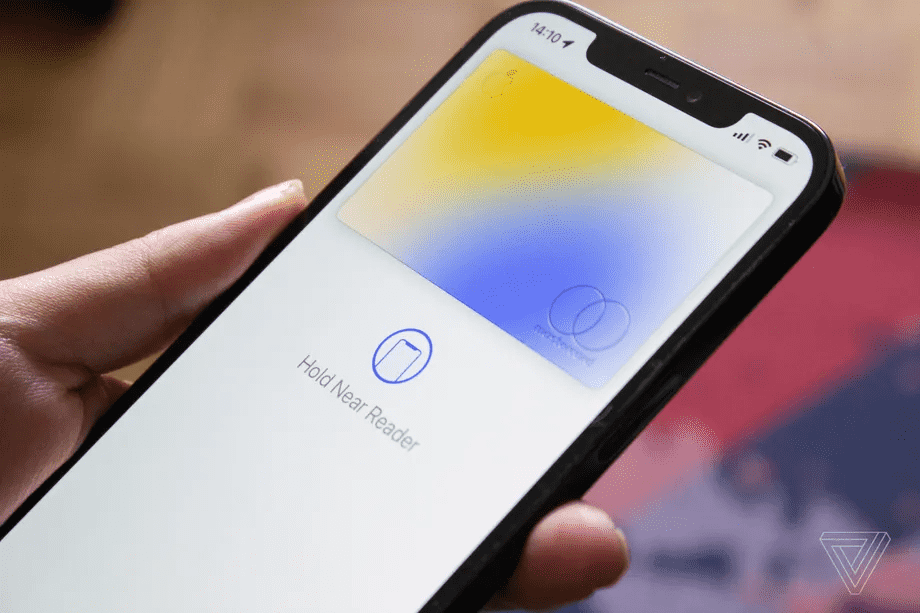

According to the complaint, Apple makes over $1 billion a year charging credit card companies up to 0.15 percent per transaction in Apple Pay fees, and yet those same card issuers don’t have to pay anything when their customers use “functionally identical Android wallets.” The suit alleges that Apple violates antitrust law by making it so Apple Pay is the only service able to carry out NFC payments on its iPhones, iPads, and Apple Watches. It also alleges that Apple keeps card issuers from passing on those fees to customers, which makes it so iPhone owners don’t have any benefit to go find a cheaper payment method.

However, even if a judge agrees to this, they could still decide that there’s no real monopoly because customers can always switch to Android, where other mobile wallets exist.

The law firm handling the case for Affinity, Hagens Berman, has a history of class-action suits against Apple; it was involved with getting developers a $100 million settlement after alleging that the App Store’s rules were unfair, as well as with the e-book price-fixing case that ended with Apple returning around $400 million back to customers.

The aim of the lawsuit, according to a press release from the law firm, is to change the Apple policies that force all contactless payments to go through Apple Pay and to make the company reimburse card issuers for the fees that the plaintiffs claim it illegally charged.

In addition, the EU recently objected to the fact that third-party developers can’t use the iPhone’s NFC system for payments, claiming that the restrictions lead to “less innovation and less choice for consumers for mobile wallets on iPhones.” Now, the company could face a legal battle over the issue in the US as well.