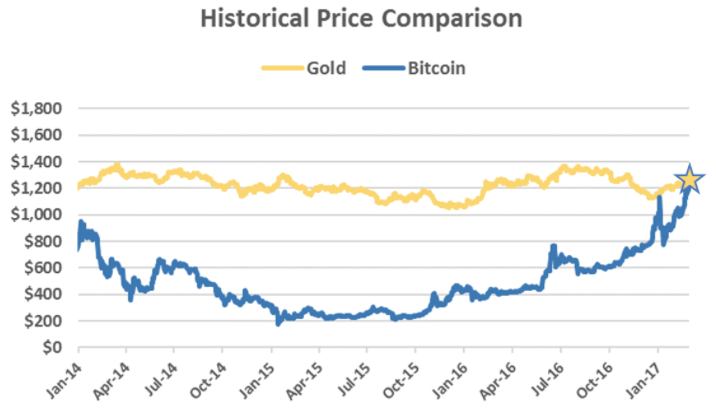

Anyone who is following the price of bitcoin gets tired just like the one who is hiking across a mountain range. From a very high price of $19000 last year to approximately $10000 today, the price is changing so quickly that the average calculation of the cryptocurrency soon gets outdated. The prices also vary depending on where you are looking for it. This is how the price of bitcoins is always confusing. Small things that you can keep in mind while investing in the cryptocurrencies next time unless you employ one of best bitcoin trading brokers.

The price at any moment is a result of the trading that is happening on cryptocurrency exchanges. The process is called Price Discovery. For instance, take coinbase.com, it’s a very popular portal for people who want to buy or sell Bitcoin. If you are making a purchase on coinbase, the entity who is selling you the bitcoins or other cryptocurrency is coinbase itself. Coinbase also has a sister exchange called the Global Digital Asset Exchange or GDAX. It is a marketplace for professional traders and institutions. This is the main area where the price discovery is taking place. The price of the last trade on GDAX becomes the value of Bitcoin at the moment. This is also the price that you see on Coinbase.

Adam White, the general manager of GDAX says, “What’s the price of Bitcoin trading? Or the price of Ether?’ It’s not any company that sets it. That price is discovered on open exchanges through individuals and institutions trading with one other.” In short, the price of Bitcoin on Coinbase comes from the trading that took place on GDAX. When someone is purchasing a bitcoin from Coinbase, it checks the GDAX to give the customer a price. White says, “Coinbase looks to the GDAX marketplace to quote that customer a price.” If the customer wants to buy the bitcoin on the quoted price, it buys it off GDAX as a middleman in the game.

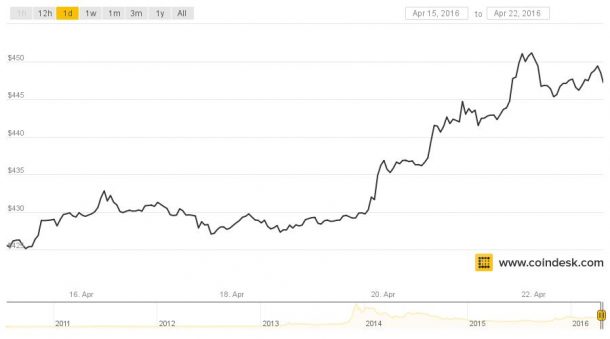

Coinbase and GDAX are not the only players of cryptocurrency in town. Many other well-known exchanges including Bitstamp, Poloniiex, and Kraken are also playing their part in it. There are also aggregators who are looking into what is happening on multiple exchanges and then calculates the average to get an appropriate number. CoinDesk is one of the famous aggregators. This is how the prices vary. Every exchange might show a little different amount depending on what the last trade price was, however a platform like CoinBase looks at multiple sources at the same time.

Christian Catalini, assistant professor of technological innovation at the MIT Sloan School of Management said, “Bitcoin exchanges are managing an order book. Which is basically a list of people, at any point in time, willing to buy or sell at different prices. What they do is, they match demand and supply. And that process of matching the two sides of the market is what leads to the price discovery.”

While talking about the price of Bitcoin, which is far less than it was last year, he said, “space was ripe for a correction after the craziness of the end of 2017.”

I bow down humbly in the presence of such gressneat.